U.S. middle-market private equity activity remained strong throughout 2015 as elevated transaction multiples were accompanied by unprecedented levels of debt. The continued abundance of cheap liquidity will likely keep deal prices elevated for the near term, which is good news for sellers. The current marketplace has positioned sellers to achieve more favorable deal terms: decreased equity contribution, lower cap on indemnification of reps and warranties, reduced escrow, and shortened holdback periods. There is a still a shortage of above-average companies for sale, and increased prices reflect this trend. Alabama has been slow to recover from the recession, but at PW&Co, we have finally begun to see an uptick in businesses looking to grow – raising growth capital or expanding through acquisition – a positive sign for the Alabama economy.

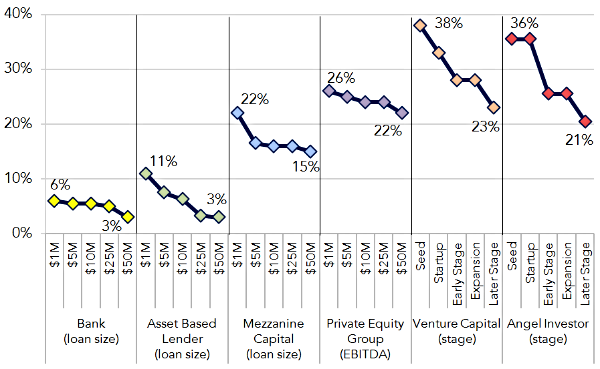

Click here to download the full report with a more in-depth look at the statistics and recent valuation trends. The chart below shows estimates of required rates of return for different market participants: banks/senior lenders, asset based lenders, mezzanine lenders, private equity groups, venture capital firms, and angel investors. Returns shown are based on survey data and not actual transactions, and should be considered indicative only. Additional detail is provided in the full report.

Figure 1: Private Capital Markets Cost of Capital by Size and Stage

Our quarterly valuation review explores recent valuation trends in the public and private markets, directed to small and middle market business owners and the professionals and financial institutions that serve them. The review is designed to provide realistic guidance on the question “What’s it Worth?,” keeping in mind that proper preparation for real world transactions requires analysis of specific situations based on up to date data.