In This Issue

In “YTD 2020 Bank Valuations” we review YTD Regional and Community Bank deal valuations.

In “YTD 2020 Bank M&A Scorecard” we review YTD Community Bank M&A transactions.

In “M&A Strategies During the COVID-19 Pandemic” we discuss our thoughts on appropriate M&A strategies given the impact of COVID on the economy.

In “Porter White Community Banking Practice” we give a brief overview of our firm’s commitment to Community Banks and contacts for additional information.

YTD 2020 Bank Valuations

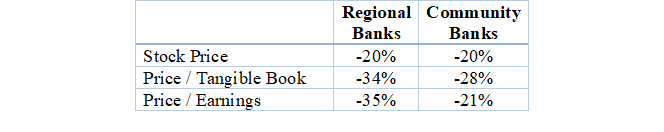

Both Regional and Community bank stocks have fallen approximately 20% since year end 2019. However, M&A multiples for Regional Banks have fallen approximately 35% YTD versus approximately 25% for Community Banks. This discrepancy is probably due to the higher COVID impact risk levels at Regional Banks, specifically larger exposures in energy, hotel, casual dining, and mall related real estate.

Table 1 shows YTD movement as of July 15, 2020 in (i) stock price of 22 Regional and 151 Community Banks in the Southeastern US and (ii) Price/Tangible Book and Price/Earnings valuations for 49 nationwide bank acquisitions recorded YTD.

Table 1: Price Changes Year-to-Date July 15, 2020

YTD 2020 Bank M&A Scorecard

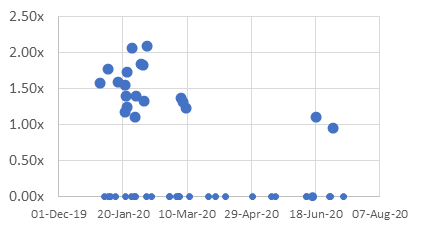

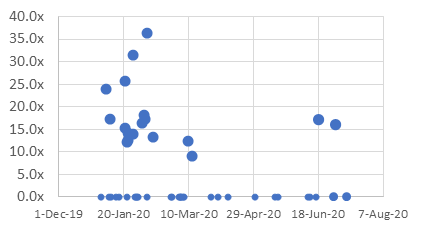

Figures 1 and 2 provide a detailed view of the 49 Community Bank transactions that have occurred across the country through YTD July 15, 2020. Each blue dot represents a transaction. The small dots on the X axis represent transactions that have not reported a Price/Tangible Book or Price/Earnings multiple. These are typically small one or two branch mergers. The large dots in the body of the graph correspond to actual reported deal valuations.

The old saying a picture is worth a thousand words holds true for this analysis. Deal volume and valuations has fallen drastically since COVID-19 appeared on the national stage in mid-March. The most recent deal with announced multiples, a $10B+ merger of equals in Long Island, NY announced on July 1, carried a 0.96x P/TB, one of the lowest multiples since 2009.

Figure 1: Transaction Multiples – Price/Tangible Book

Figure 2: Transaction Multiples – Price/Earnings

M&A strategies during the COVID-19 pandemic

Overview

Porter White & Company (“PW&Co”) reviewed almost 4,000 community bank M&A transactions since 2001 to determine the impact of county economic standing (as measured by GDP) on deal activity and transaction pricing. We believe this analysis may be useful as Alabama banks work through the economic impact of the COVID-19 pandemic. A summary of our findings and their implications follows.

- The economic cycle drives M&A across all counties, regardless of economic standing. COVID-19 has dramatically slowed 2020 deal volume.

- When ranking transactions by economic standing of the headquarter counties of the target, top quartile counties (counties with higher GDP relative to other counties in a state) represent the bulk of M&A activity. It should be noted that top quartile counties represent 80% of the nation’s GDP.

- Top quartile counties have more M&A pricing volatility than deals in smaller GDP counties. Bank transactions in top quartile counties carry valuation premiums as compared to lesser GDP counties; however, these premiums disappear in recessions.

- Banks headquartered in smaller GDP counties but with a branch presence in larger GDP counties receive M&A premiums like banks headquartered in large GDP counties.

Given the above, we believe bankers should consider the following M&A strategies during and after the current COVID-19 induced recession.

- More than ever, if you pursue an acquisition, make the banks have a cultural fit. The combined teams may face some unprecedented credit conditions when the deal closes, so both banks should know their credit portfolio and their employees’ capabilities very well.

- Large GDP county banks should consider avoiding sell-side activity until the economy improves. Well capitalized large GDP county banks may consider purchasing other large GDP county banks at a COVID-19 discount or consider stock transactions.

- Smaller GDP county banks who wish to sell may receive a COVID-19 based “low ball” offer below the 1.00x-1.30x Price/Tangible book these banks typically receive.

- If you do decide to sell your bank, strongly consider taking stock. It will help you control your destiny through the COVID-19 pandemic and will probably provide favorable returns over time.

- Well capitalized smaller GDP banks should consider expansion into higher growth counties, either de novo or through purchase of divested branched from larger banks, as these assets could improve the banks’ Price/Tangible book multiple.

Analysis Methodology

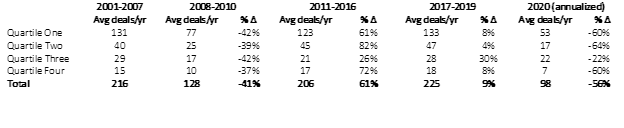

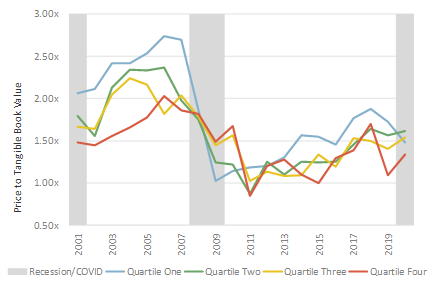

PW&Co utilized databases from S&P Global Market Intelligence and the Bureau of Economic Advisors to analyze the impact of the local economy on 3,848 Community Bank M&A transactions across the nation since 2001. The S&P database contained deal multiples and the target bank’s headquarters location by county. The BEA data provided GDP information by county. We ranked each county in each state by GDP size for every year from 2001-2018 and assigned each county a quartile designation within their respective states. Counties which produced the top 25% of a state’s GDP each year were in Quartile One for that year, counties producing 25-50% were in Quartile Two, etc. We then matched target banks headquarter counties with GDP quartile ranking, resulting in an ability to assess GDP impact on deal volume and pricing. Our findings are summarized in Figure 3 and Table 2 below.

M&A strategies in a COVID-19 recession

Of the four findings mentioned above, the first three seem evident from the figure and table below. Our discussion will therefore focus on the fourth finding involving Quartile Three or Four banks establishing branch presence in Quartile One counties.

Several Quartile Four banks in 2008 had Price/Tangible Book sales prices in the 1.90x – 2.00x range, versus the typical 1.20x-1.40x (see red line in Figure 3). These transactions typically involved banks with asset size $200-$500mm, and 5-7 branches with one or two branches (including the headquarters) in Quartile Four counties. However, in most cases these banks had adjoining Quartile One counties which held the bulk of the bank’s branches and assets. Hence, the Quartile One type valuation for a Quartile Four bank.

This relationship would hold true for Alabama banks. The COVID-19 environment may reduce asset values in Quartile One counties and many Alabama Quartile Three and Four banks have abundant capital to purchase these assets, and low loan/deposit ratios to support growth in those assets. This could be a winning combination.

Table 2: Community Bank Deal Volume by County Quartile 2001-2020

Figure 3: Community Bank Price/Tangible Book M&A Pricing by County Quartile

Porter White Community Banking Practice

PW&Co has been serving the needs of Alabama’s Community Banks since 2016 and has participated in 10 M&A transactions during that time. Our most recent transaction was as financial advisor to the Haleyville, Al based Traders & Farmers Bancshares, Inc in its July 2020 merger with BankFirst Capital Corporation of Macon, Ms. This $49 million transaction resulted in the creation of a $1.8 billion bank serving central and northern Alabama and Mississippi.

For additional information on M&A strategies in the age of COVID or any other capital related issues please contact Mike Murphey or Michael Stone. Additionally, we will be attending the Alabama Bankers Association CEO Conference at the end of this month and would enjoy the opportunity to speak with you at that time. Finally, I encourage you to follow the Porter White Twitter feed at @porterwhite_co. and visit our Community Banking page. These sites are updated with information helpful to Community Bankers.