The municipal market remained relatively stable in August, as weekly 30-day volatility of 10-year AAA GOs increased modestly from 0.27 to 0.42 over the month. Municipal supply in August remained high with monthly issuance of $41.4 billion, a 5% increase from August 2019. YTD municipal bond issuance has increased 21% from 2019 levels. Long-term interest rates increased slightly during August, but short-term rates remained unchanged. On August 27th, the Federal Open Market Committee (FOMC) announced updates to its Statement on Longer-Run Goals and Monetary Policy Strategy, which lays out the Federal Reserve’s approach to monetary policy and guides its actions. Among other changes, the updated policy aims to average 2% inflation over time. With inflation currently under 2%, this indicates that the Fed will aim to let inflation increase moderately above 2% for some time before taking action (i.e., reducing rates) to curb inflation. This updated Fed strategy change combined with current COVID-19 environment, suggests that interest rates could remain low for quite some time.

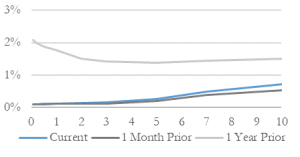

US Treasury Yield Curve

Our Municipal Market Update is data-driven, one page sheet that is intended to give you an overview of key interest rates – floating as well as the credit spreads of key local and state entities with data as of August 31, 2020. It is written for those making credit and investment related decisions for municipalities and non-profit institutions. If you have additional questions or would like to learn more about our municipal advisory and investment banking services, visit our Municipal Advisory page and contact Michael Stone, CFA.

Click here to access our Municipal Market Update.