U.S. private equity deal activity and total transaction value dipped slightly in Q1 2019, but prices on completed deals remain elevated. Continued record-breaking fundraising efforts and private equity dry powder (funds raised but not yet invested) will likely continue to drive competition and push deal prices upwards. Private equity firms continue to search aggressively for smaller deals in the lower middle market, which is often less competitive and lacks the strategic acquirer interest.

Click here to download the full report with a more in-depth look at the statistics and recent valuation trends.

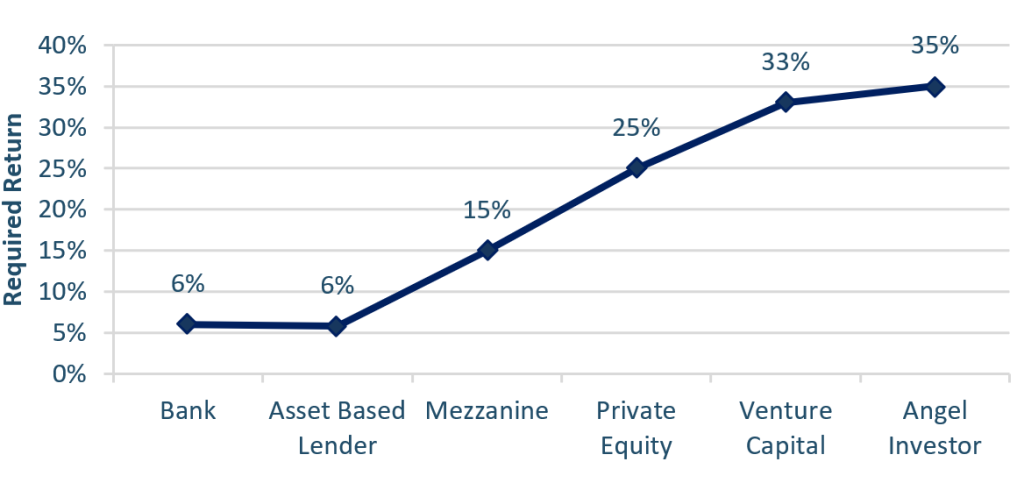

The chart below shows a snapshot of required rates of return for different market participants: banks/senior lenders ($5M loan size), asset based lenders ($5M loan size), mezzanine lenders ($5M loan size), private equity groups ($10M EBITDA), venture capital firms (startup investments), and angel investors (startup investments). Returns shown are based on survey data and not actual transactions and should be considered indicative only.

Our valuation review explores recent valuation trends in the public and private markets, directed to small and middle market business owners and the professionals and financial institutions that serve them. The review is designed to provide realistic guidance on the question “What’s it Worth?,” keeping in mind that proper preparation for real world transactions requires analysis of specific situations based on up-to-date data.