Porter, White & Company presents Principal Trends and Interest, a newsletter for community banks. In this issue we look at the curious case of today’s M&A environment and two services banks require but often overlook.

- 2014 M&A Scorecard: Clear as Mud?

- What to do about Distressed Business Borrowers?

- My Bank’s ESOP Needs Advice

2014 BANK M&A SCORECARD: CLEAR AS MUD?

The 2014 bank and thrift merger results are in and they paint a mixed picture about how much the deal marketplace in the industry has recovered from the Great Recession.

On One Hand, Deal Flow has Returned…

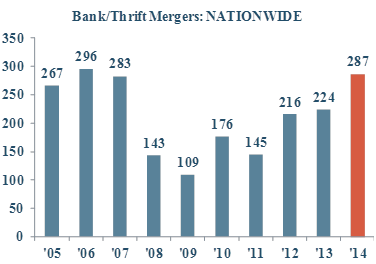

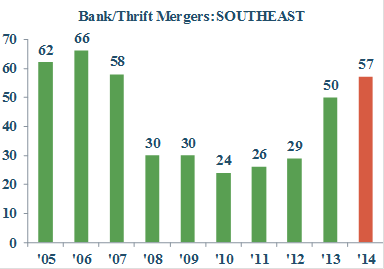

Deal activity in 2014 jumped noticeably over 2013 and returned to pre-recession levels for both the nation and the Southeast.

Note: All chart data courtesy of SNL Financial.

…But on the Other Hand, Pricing Continues to Lag…

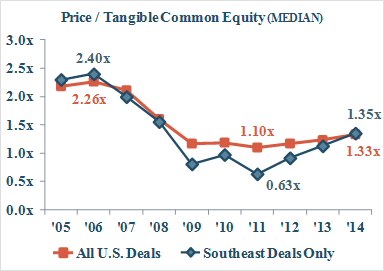

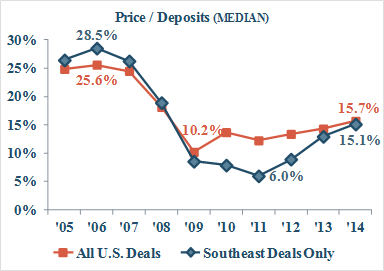

Deal pricing clearly continues to trail pre-recession valuation levels when looking at Price/Tangible Book multiples or Price/Deposit multiples.

…As Bank Fundamentals Slowly Revert to Pre-Recession Levels.

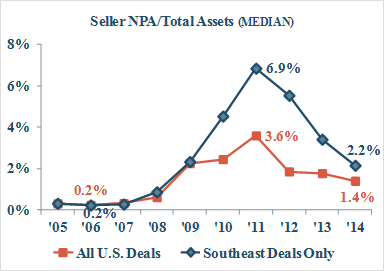

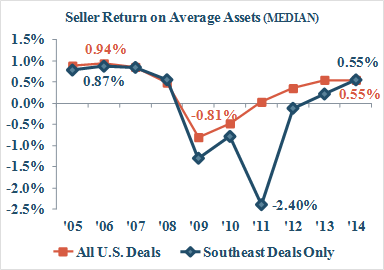

A multitude of factors beyond the scope of this article drive M&A valuation levels. Nonetheless, a fundamental analysis of selling banks over the last decade shows certain asset quality and operating measures that, while improving, have yet to rebound to pre-recession levels and partially explain why the pickup in deal pricing lags the increase in deal activity.

The Nonperforming Assets/Total Assets ratio of sellers nationwide in 2014 was 1.37%, which is a significant improvement over the 2011 median ratio of 3.60% but still over twice the ratio in 2008 (0.60%). Sellers nationwide in 2014 had a median Return on Average Assets (ROAA) of 0.55%; this is dramatically better operating performance than reported by sellers in 2009-10 but still 30 to 40bps below the ROAA’s of sellers in 2005-07.

If banks up for sale in 2015 exhibit credit and operating performance more in line with sellers before the recession, it will be interesting to see if the valuations they command will more closely resemble pre-recession pricing.

Please contact Michael Stone, CFA (205.252.3681; michael@pwco.com) for more information on the bank M&A marketplace.

DISTRESSED BUSINESS BORROWERS? WE CAN HELP.

The following case study recounts an actual assignment in which Porter White helped a financially-distressed business borrower and a lending syndicate resolve a difficult situation.

The Problem: Fraud is uncovered at a mortgage company that is using the same collateral to borrow from multiple banks, which leads to a difficult decision for the bank group. Should they continue funding operations in order to keep the company alive long enough to salvage some value through a sale?

The Solution: At the behest of the lending banks, PW&Co stepped in as interim CFO at the mortgage company providing assurance that cash flow was appropriately accounted for and properly applied against loans funding the company. With continued bank support, the company could meet its funding commitments and retain its reputation in the market while giving comfort to the funding banks that their collateral was secure. While PW&Co managed the financial operations of the mortgage company, a buyer was found preserving the company as a going concern and salvaging some value from a difficult situation.

It’s situations like this where Porter White can offer its expertise in advising parties to a loan relationship where the borrowing business is in a financially-distressed situation. Whether the situation is in- or out-of-bankruptcy, our team has the experience and mature judgment to address difficult situations, manage short-term cash planning and reporting, and structure transactions to achieve the most favorable terms for each client.

- Financial advisory, business & financial planning

- Cash flow forecasting, financial modeling/budgeting

- Financing: debt or equity

- Trustee or receiver

- Interim management (CFO/CRO)

- Sale of business

- Collateral agent

- Business valuation

Please contact Michael Stone, CFA (205.252.3681; michael@pwco.com) to learn how PW&Co can help your bank address loans in which the business borrower has become financially-distressed.

DOES YOUR ESOP NEED ADVISORY SERVICES? CALL US TODAY.

Trustees of bank Employee Stock Ownership Plans (ESOPs) are presented with unique and oftentimes complex challenges related to these vehicles. ESOPs bring with them special fiduciary risks which can be reduced through appropriate independent, third-party advice. If your bank’s ESOP requires valuation, fairness opinion or other advisory services, call Porter White today. We’ve valued hundreds of businesses in the last several years in a variety of ESOP, estate planning and gift contexts and our staff includes three Chartered Financial Analyst (CFA) holders and an Accredited Member of the American Society of Appraisers.

Please contact Michael Stone, CFA (205.252.3681; michael@pwco.com) for more information on how we can help your bank’s ESOP.