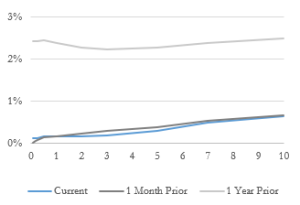

The one-year tax-exempt AAA rates hit an all-time low in May, declining from a peak of 2.51% in March to as low as 0.11% in May. The 30-year tax-exempt AAA rates declined approximately 50 basis points in May; however, credit spreads widened for many issuers, particularly those impacted directly by COVID-19. The uncertainty and volatility due to COVID-19 still remains high. The Federal Open Market Committee (FOMC) plans to pause all new policy initiatives at their upcoming June meeting and the implied futures market anticipates near-zero Fed Funds rates for the remainder of 2020.

US Treasury Yield Curve

Our Municipal Market Update is data-driven, one page sheet that is intended to give you an overview of key interest rates – floating as well as the credit spreads of key local and state entities with data as of May 29, 2020. It is written for those making credit and investment related decisions for municipalities and non-profit institutions. If you have additional questions or would like to learn more about our municipal advisory and investment banking services, visit our Municipal Advisory page and contact Michael Stone, CFA.

Click here to access our Municipal Market Update.