July marked the fourth full-month of the COVID-19 global pandemic, which continues to disrupt the municipal market. The one-year tax-exempt AAA rates decreased back to its all-time low in May 2020 and interest rates are not expected to increase in the near term. At its July meeting, the FOMC stated that the Fed intends to maintain near zero interest rates until it is confident that the economy has stabilized and, specifically, “the path of the economy will depend significantly on the course of the virus.” When asked about raising rates, Fed Chair Powell responded by saying, “We’re not even thinking about, thinking about, thinking about raising rates.” Needless to say, based on the commentary from Chair Powell and how distant they are from even “thinking about” raising rates, rates could remain low for quite some time, and the length will depend significantly on the impact of COVID-19 on the economy.

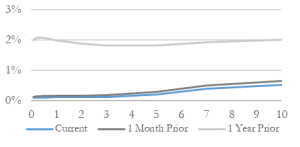

US Treasury Yield Curve

Our Municipal Market Update is data-driven, one page sheet that is intended to give you an overview of key interest rates – floating as well as the credit spreads of key local and state entities with data as of July 31, 2020. It is written for those making credit and investment related decisions for municipalities and non-profit institutions. If you have additional questions or would like to learn more about our municipal advisory and investment banking services, visit our Municipal Advisory page and contact Michael Stone, CFA.

Click here to access our Municipal Market Update.