Some 401k Plan Sponsors have taken the approach of providing a broad range of investment options hoping that providing a few, low-cost index funds would fulfill their fiduciary duty to monitor fees and expenses of their plan. The logic here was that a participant is free to choose between low cost and higher cost investment options in the plan, so the plan sponsor does not need to monitor all of the investment options so closely. The US Supreme Court disagreed.

The U.S. Supreme court sent a message to the retirement plan community early in 2022 via an opinion delivered in the case, Hughes versus Northwestern University. The plaintiffs, employees of the university, filed a lawsuit against Northwestern, alleging that the plan administrators violated their duty under ERISA to make prudent decisions, citing the number of investment offerings, alleging poor-performing investment options, and alleging excessive fees.

The Court of Appeals for the Seventh Circuit ruled that these allegations fell short, and any concern that plan options were imprudent were alleviated by low-cost investments that were available as plan options in addition to the high cost options. The Supreme Court case decided 8-0 in favor of the plaintiffs, writing in their opinion[i], “That reasoning was flawed. Such a categorical rule is inconsistent with the context-specific inquiry that ERISA requires and fails to take into account respondents’ duty to monitor all plan investments and remove any imprudent ones. See Tibble v. Edison Int’l, 575 U. S. 523, 530 (2015).”

The Northwestern 403(b) plan had more than 400 investment choices, and the high court ruled that offering workers a broad range of choices did not shield employers from claims that some of the funds on the menu were imprudent selections because of their high fees. The plaintiffs also brought forward that the university did not utilize lower-cost institutional-class mutual funds that are identical to the more expensive retail-class funds that were in the plan.

The Northwestern case serves as a warning to plan sponsors that need to make sure that plan fees are reasonable and all investment options prudent, as well as to draw attention to the potential liability (all of which is manageable) associated with the responsibilities of a plan sponsor.

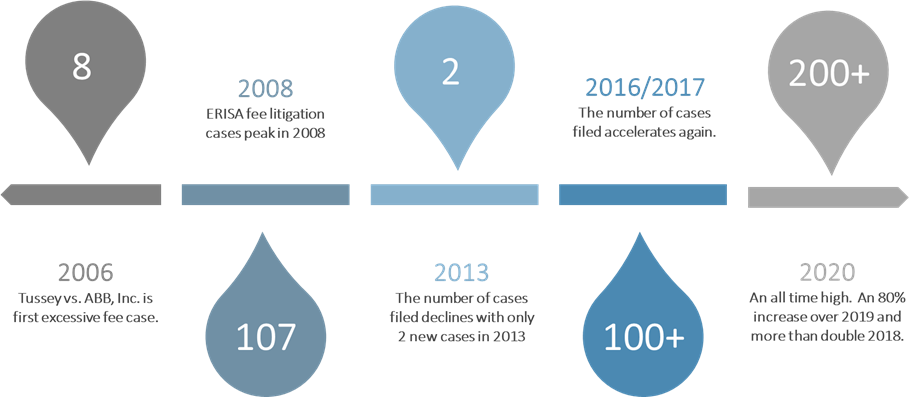

Figure 1. Trends in ERISA Litigation

ERISA fee litigation has been increasing recently. Plan sponsor failures to meet their obligations could cause not only increased cost to participants at the time, but costs to the company later through class-action settlements and regulatory penalties.

A plan sponsor should be working for the sole benefit of the participants. Among other things, this includes selecting and monitoring plan investments, monitoring plan costs for reasonableness, and overseeing and properly documenting plan administration. ERISA doesn’t require fiduciaries to always be right; ERISA requires fiduciaries to be prudent. The linchpin of prudence is a process. Plan sponsors should establish investment and administrative processes, follow the processes and document compliance them.

The bigger a plan sponsor is, the bigger the target they are for lawsuits. But no matter the size of the plan, it is important for the plan sponsor to be able to show that they followed a prudent process, whether managing the investments themselves or outsourcing it to an ERISA fiduciary.