In our recent investment commentary, we highlighted research regarding plan design and plan participants. The research clearly highlights the effects that plan design can have on plan participants and retirement outcomes. While the study largely confirms that automatic enrollment has a strong effect on participant saving and investing behavior, it also alleviates fears that many plan sponsors have in making these elections for employees. Only ~5% of participants in plans with an automatic enrollment feature made changes to reduce the savings behavior created by those features. Please reach out if you have any questions regarding the commentary or the plan design of your plan.

I. Overview

Using an automatic enrollment feature in defined contribution plans, eligible participants are automatically enrolled in the plan at a set deferral rate, with the ability to opt-out at any moment. In “Automatic enrollment: The power of the default[i],” Vanguard’s Jeffrey W Clark and Jean A. Young draw from 42 months[ii] of Vanguard recordkeeping data to provide updated statistics to their previous report on the effects of automatic enrollment on participant behavior. While the study largely confirms that automatic enrollment has a strong effect on participant saving and investing behavior, it also alleviates fears that many plan sponsors have in making these elections for employees. Only ~5% of participants in plans with an automatic enrollment feature made changes to reduce the savings behavior created by those features.

II. Participation Rates

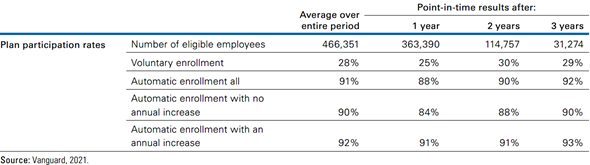

As seen in Figure 1 below, the participation rate for new employees was 91% through automatic enrollment versus 28% through voluntary enrollment, tripling the participation rates among new employees. There is also an effect on participants remaining active in the plan. After three years, 92% of automatically enrolled participants remained active, compared to 29% of participants who enrolled voluntarily.

Figure 1. Participation Rates and Automatic Enrollment

The demographics of participants that one would intuitively think are most effected by automatic enrollment are supported by the research data. Researchers noted that automatic enrollment has the greatest impact on participation among young and low-income employees. Notably, via automatic enrollment, 9 out of every 10 employees under the age of 25 became plan participants, compared to less than 2 out of 10 under voluntary enrollment.

III. Contribution Rates

One consideration when establishing an automatic enrollment feature is whether to establish an annual increasing deferral rate. Vanguard’s research showed that for both increasing and non-increasing deferral rate plans, more than 9 in 10 participants remained at the initial default deferral rate or higher versus choosing to lower their deferral rate.

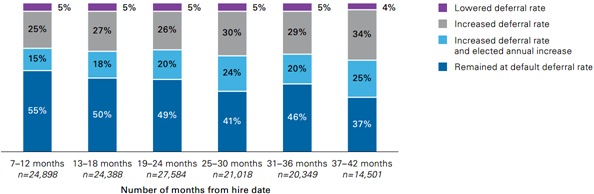

As seen in Figure 2 below, in automatic enrollment plans without an increase option, the proportion of participants who continue to defer at the default deferral rate established by the plan sponsor decreases over time, and only 5% made changes to lower their deferral rate. One-third of participants, after three years, had decided to adjust from the plan sponsor’s default and increase deferral rates, while another quarter chose to adjust the default, increase their deferral rate, and sign up for a deferral rate rise.

Figure 2. Automatic Enrollment with no Annual Increase

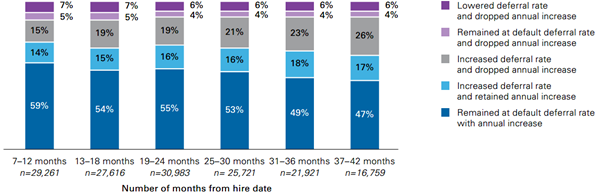

In automatic enrollment plans that contain an annual increasing deferral rate feature (Figure 3), while half remain in the original deferral rate design, another 17% increased their contribution rate and retained the increase feature, meaning two-thirds of the participants retrained the increase feature.

Figure 3. Automatic Enrollment with an Annual Increase

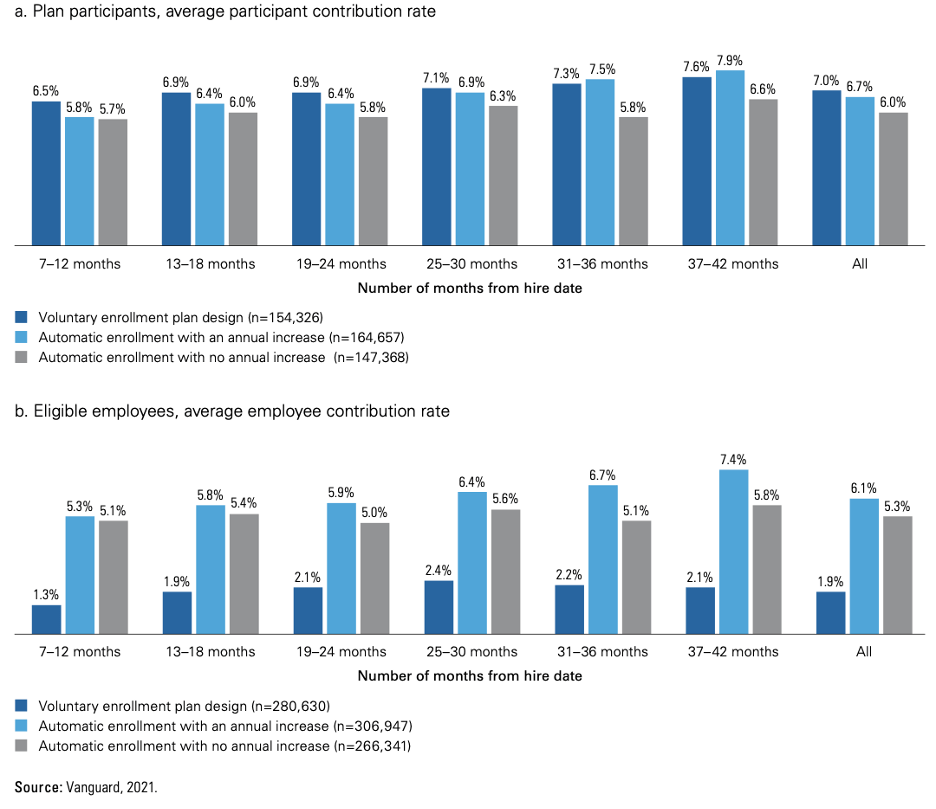

One thought concerning automatic enrollment that the researchers addressed is the criticism that plan sponsors can set automatic deferral rates at a level where participants who would have voluntarily enrolled at a higher deferral rate remain at the reduced automatic deferral rate. The research showed that it is true that the average contribution rate for participants in voluntary plans is slightly higher (Figure 4a), but only the individual participants are considered in this scenario. If you consider all employees, including non-participant employees who contribute nothing to retirement, outcomes through automatic enrollment are much more favorable (Figure 4b). Additionally, in recent years, there has been a trend among plan fiduciaries to raise the default deferral rate from rates long thought to be low enough to dissuade opt-outs, to something stronger, causing the spread between voluntary and automatic deferral rates over time to decrease.

Figure 4. Employee Average Contribution Rates Over Time

IV. Default Investment Fund

The research also looked at the impact of automatic enrollment on the investment decisions by participants. Those in automatic enrollment plans are approximately 30% more likely to remain in the default investment selected by the plan sponsor. 86% of participants in automatic enrollment remained fully invested in the default option versus 66% in the default who chose their own investment option via voluntary enrollment. Across the board, these choices remained “sticky” over time. This data certainly supports the need for in-depth discussion and thought around the default investment option chosen by the plan sponsor.

V. Conclusions

The research clearly highlights the effects that plan design can have on plan participants and retirement outcomes. Automatic enrollment is one such design that can be critical in improving plan participation and saving rates amongst employees. The data shows higher participation rates compared to voluntary enrollment, and higher retirement savings rates when considering the replacement of non-contributors with contributing participants. Practical discussions should be had when considering the automatic deferral rate associated with automatic enrollment.

Plan design is obviously not a one size fits all solution, so work with an expert to help determine what works best for your plan, because productive default designs can improve retirement outcomes for employees.

Important Note:

(a) Past performance is not a guarantee of future results.

(b) There is no guarantee that an investment strategy will be successful.

(c) Investing involves risks including possible loss of principal.

(d) This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

[i] https://institutional.vanguard.com/iam/pdf/ISGAE_022020.pdf

[ii] The research is spans across 520 plans, specifically concentrating on newly hired eligible participants who were hired between January 1, 2017 and December 31, 2019, and are still employed as of June 30, 2020