M&A is Back

Say what you will about 2020, Alabama’s banking system changed on a dime to meet the needs of our clients and local economies. Think about it. Branches closed, digital services grew, employee and customer health needs were addressed, a whole new class of loans was created, delivered, and monitored, all the while working in an environment with record low interest rates, record high unemployment, and the most dramatic inflow of deposits our industry has ever seen. No wonder M&A stopped in 2020. But its back. This article will discuss what may drive buy side, sell side or merger of equal activity in coming months.

Your Bank will Probably Have a Good 2021 With or Without M&A

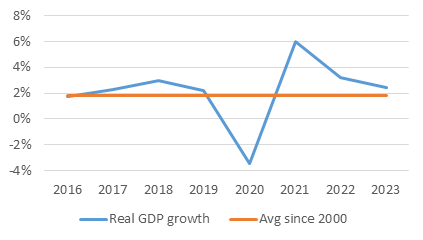

At its heart banking is a pretty simple business. When the economy does well, banks do well. For reasons we already know, 2021 and probably 2022 will be strong economies.

Historic and Predicted GDP

Source: Federal Reserve Bank of St Louis and WSJ Economist Survey, April 2021

So why think about M&A? COVID changed everything, including some basic components of the community bank business model. Some are listed below. It’s incumbent on boards and management to consider these issues in their strategic discussions and make judicious capital decisions to maximize shareholder returns. Ongoing strategy may include acquisitions or mergers to address these issues, or perhaps a board may decide selling is the best option. The good news is bank valuations are returning to levels where all options are on the table.

COVID Related Issues

| Issue | Industry Impact (red impacts costs) | Timing |

| Branch utilization | Potential urban closures, not impact rural | Permanent |

| Digital | Technology & HR Investments | Permanent |

| FinTech popularity | Increased competition | Permanent |

| Ultra-Low Rates | NIM compression, overhead reductions | 2-3 years |

| Massive economic subsidies | Industry positive, deposit growth | 2-3 years |

| Significant deposit growth | Stimulus & QE in 2021, QE in 2022 | 2 years |

| SBA Programs | Industry positive, operational challenge | ???? |

| Slowing Loan growth | NIM compression, overhead reductions | 1 year |

| Slowing Mortgage Refis | Less loan sales, overhead reductions | now |

| Higher Corporate Taxes | Significant return impact | Permanent |

| Regulation | Additional costs, M&A scrutiny | 4 years??? |

| Capital Gains & Estate Tax | Impact wealthy shareholders | Permanent |

The Economics of Community Bank M&A

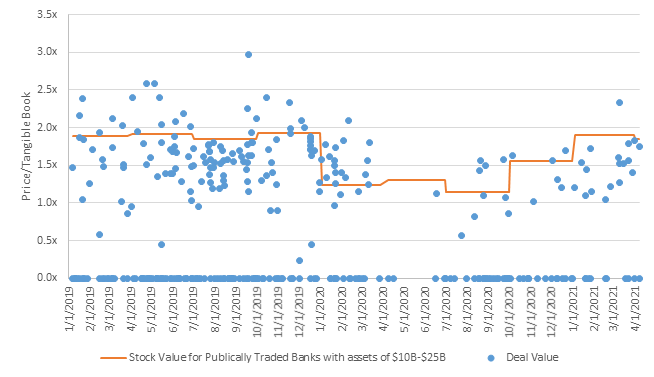

Two fundamental drivers of M&A pricing are the economy and stock valuations of regional banks. Regional banks are big acquirers of community banks; they set a floor on deal pricing. Bank stocks are highly correlated to the economy, and the interplay of these factors is reflected below. The chart covers 348 community bank1 M&A transactions since 2019 (the blue dots), as well as the Price/Tangible Book of 49 publicly traded bank stocks with assets between $10B-$25B (orange line). Pre COVID, regional banks were trading just below 2x book, and a lot of deals were being done around that benchmark. COVID hit in early 2020, bank values fell by nearly 50%, and M&A dried up. Recent months reflect a strong comeback in bank values, nearly equaling the pre pandemic level, which in turn is driving an uptick in M&A activity and pricing. That is why M&A is back.

Mid-Size Regional Stock Price Valuations and Community Bank M&A Deals Since 2019

Source: S&P Global Market Intelligence

Buy, Sell or Merge?

So what does your bank do? The following charts tell a compelling story. The first two charts say bigger is better from a valuation, return and efficiency perspective. Chart three says acquiring banks can generate significant cost saves from acquisitions. Add these findings in with the “red letter” issues outlined above, and you can see cost pressures may force boards of smaller banks to consider a sale or a merger of equal strategy to build scale, reduce costs and enhance shareholder value and return.

From the buy side, larger community banks or public regional banks are natural acquirers of smaller banks in a similar locale, as they have the valuation and capital to fund accretive acquisitions through cost cuts shown in graph three. Additionally, it’s worth using stock as consideration in small bank acquisitions, as it provides selling shareholders a potential tax-free exchange as well as stock in a larger bank that may sell for 2x+ multiple down the road.

Deal Value to Tangible Book Equity for M&A Transactions by Asset Size of Acquired Bank

| Asset Size | Deal Value/Tangible Book |

| <$100m | 1.23x |

| $100m-$250m | 1.44x |

| $250m-$500m | 1.63x |

| $500m-$750m | 1.81x |

| $750m-$1B | 1.78x |

2020 Return on Equity and Efficiency Ratio by Asset Size

| Asset Size | Return on Equity | Efficiency Ratio |

| <$100m | 6.0% | 78.4% |

| $100m-$250m | 9.9% | 68.7% |

| $250m-$500m | 10.3% | 65.6% |

| $500m-$750m | 11.1% | 63.7% |

| $750m-$1B | 11.7% | 62.0% |

Estimated Cost Rationalization at Acquired Banks

| Year | Cost Savings at Acquired Banks |

| 2016 | 32.5% |

| 2017 | 34.2% |

| 2018 | 34.1% |

| 2019 | 34.9% |

| 2020 | 32.2% |

Conclusion

The Alabama community banking market consists of 95 banks totaling $26.5 billion in assets who participate in a $225 billion economy. Given current trends, the next several years will likely play a critical role in determining the structure of banking in our state.

1Banks under $1B in assets