Overview

U.S. stocks have outperformed non-U.S. stocks over the last 15 years [1]. This leads to investors frequently asking, “Why should I invest outside the U.S.?” To answer in one word: diversification.

Diversification

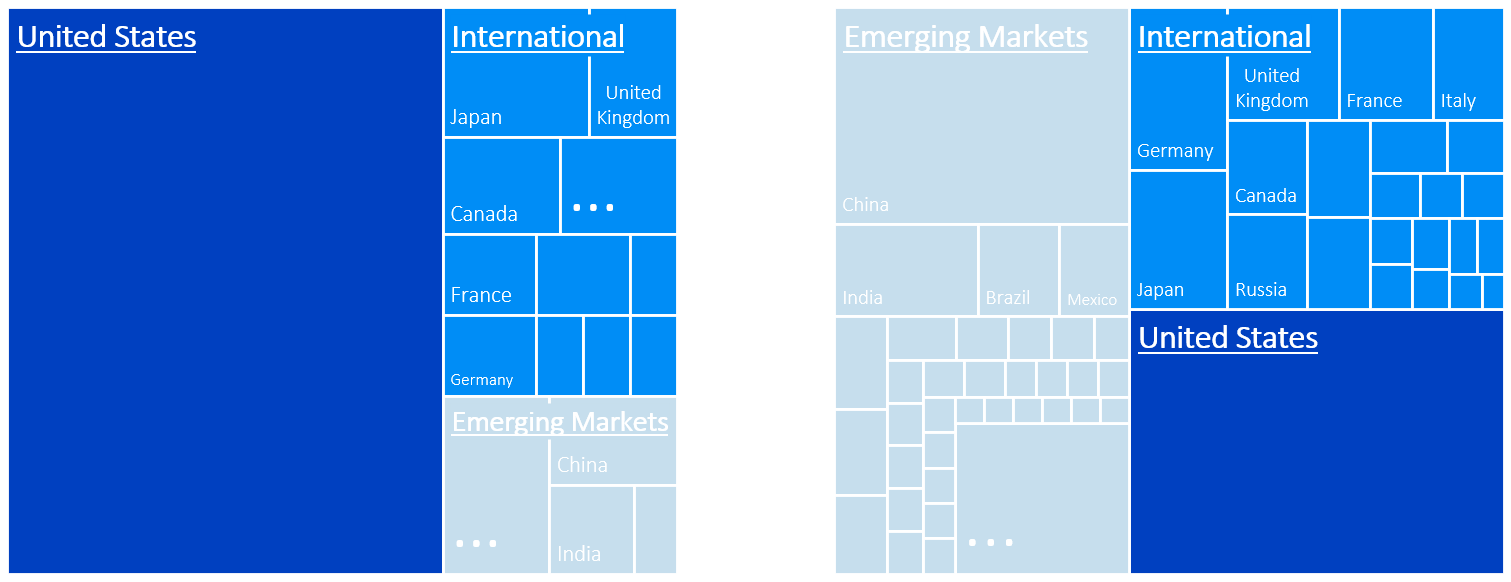

While U.S. equities make up approximately 65% of the global stock market by capitalization, the U.S. economy represents only about 26% of global GDP [2]. This mismatch highlights an important point: just because U.S. stocks have outperformed over the past decade+ and dominate global capital markets today doesn’t mean they will continue to do so. Ignoring investments opportunities outside the U.S. prevents exposure to 35% of publicly traded companies and 74% of global GDP.

Figure 1: Market Cap and Gross Domestic Product by Country

Table 1: Market Cap and Gross Domestic Product by Segment

Focusing too heavily on U.S. equities means concentrating a portfolio in a relatively small slice of the global economy which limits the potential benefits of diversification. While some multinational U.S.-registered companies may benefit from non-U.S. operations, this doesn’t close the gap. Although U.S. and non-U.S. stocks tend to move together, international exposure still plays a key role in spreading risk. It provides access to different economic drivers, market cycles, currency dynamics, and policy environments which help reduce reliance on U.S.-specific outcomes and create a more resilient, globally balanced portfolio.

Diversification’s Impact

Remember the “Lost Decade”

Given the recent domestic outperformance, it is easy to overlook the U.S. market’s prolonged underperformance during the 2000s when the S&P 500 had a negative return for the decade. In contrast, nearly all other countries across both developed and emerging markets delivered positive returns, placing the U.S. near the bottom of global rankings.

Figure 2 illustrates this contrast between the 2000s and 2010s, comparing annualized equity returns across a range of developed markets.

Figure 2: Developed Country Returns by Decade

During the 2010s, the U.S. was one of the best-performing markets, but in the 2000s, U.S. stocks had a negative return while only outperforming two developed markets and significantly underperforming most other countries and global markets as a whole.

This pattern highlights the cyclical nature of market leadership and the importance of maintaining a geographically diversified portfolio. By spreading exposure across regions, investors can reduce the risk of prolonged underperformance in any one market, such as U.S. equities from 2000 to 2010.

Volatility Reduction

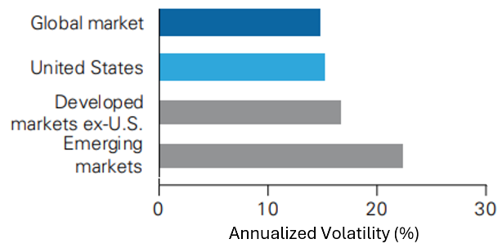

Just as sectors exhibit higher volatility due to their specific drivers, countries face their own unique risks that can be mitigated through broader diversification.

Since international and emerging markets don’t perfectly track the movement of U.S. markets, foreign investment can smooth the impact of region-specific shocks, reducing overall portfolio volatility even though non-U.S. markets are generally more volatile on their own.

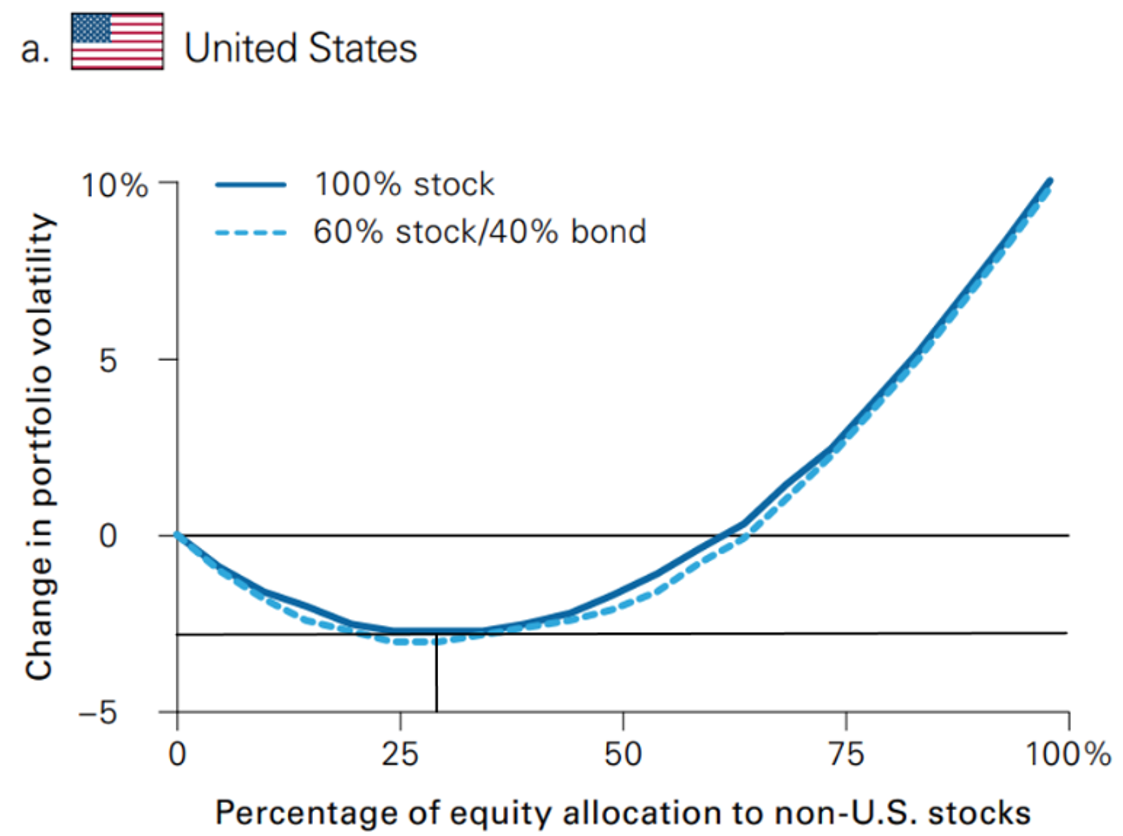

Figure 3: Global Allocation and Portfolio Volatility

As seen in Figure 3, Vanguard estimates that for U.S. investors, a 30% allocation to non-U.S. markets minimizes volatility and that the global market portfolio is less volatile than any single geographic segment.

Even as globalization has strengthened the relationship between global markets through time, the diversification benefit of investing across geography will persist because of factors specific to each country’s market such as government policy and currency strength.

Additionally, the relationship between the U.S. market and international small value stocks is weaker than the overall relationship between the U.S. market and international stocks. This means that overweight international small value allocations allow investors to seek higher expected returns while retaining the diversification benefits regarding portfolio volatility.

Conclusion

The U.S. ended 2024 on strong footing but has given up some ground in 2025. It’s worth keeping in mind, however, that the decade is still far from over. Leadership in global markets shifts over time, and the recent U.S. outperformance does not mean we can expect the strong relative performance to continue. By maintaining global diversification, investors avoid betting their future on a single economy and instead participate in opportunities wherever they arise. The goal is not to predict the next winner, but to build a resilient portfolio positioned for long-term success regardless of regional trends in the years ahead.

Disclaimer

This commentary is intended solely for informational and educational purposes and does not constitute legal, tax, investment, or accounting advice. It does not represent an offer to sell or a solicitation of an offer to buy any security, financial instrument, or investment interest. Any such offer or solicitation will be made only through formal offering documents and in accordance with applicable laws and regulations.

Certain statements contained herein may include forward-looking information, hypothetical illustrations, or projections. These are based on current assumptions and expectations, which are subject to change and involve known and unknown risks and uncertainties. Actual outcomes may differ materially due to factors such as financing availability, regulatory approvals, market volatility, force majeure events, competitive pressures, and other unforeseen circumstances.

No representation or warranty is made regarding the accuracy, completeness, or reliability of the information presented. Past performance is not indicative of future results.

This material may reference potential interest rate or market trends that are not guaranteed and may differ materially from actual results. The information herein should not be relied upon as a guarantee or forecast of future performance or interest rate movements.

This document is proprietary and may not be reproduced, distributed, or shared without prior written consent. By accepting this commentary, the recipient agrees to use it solely for its intended purpose.

[1] As of September 30, 2025. U.S. and non-U.S. stocks are represented by the Russell 3000 Index and the MSCI All Country World ex US Index, respectively.

[2] As of December 31, 2024. Market Capitalization and Gross Domestic Product data are from DFA and World Bank, respectively.

[3] Source: Vanguard. Ten-year expected returns are based on the median of 10,000 VCMM simulations as of September 30, 2020.

[4] Source: Vanguard. Data are as of September 30, 2020, for the period from January 1, 1970, to September 30, 2020. The global market return includes both developed and emerging markets. Emerging markets are represented by the MSCI Emerging Markets Index, which began on January 1, 1988. The euro area is represented by the MSCI Europe ex UK ex Switzerland Index from January 1, 1970, through December 31, 1987, and the MSCI EMU Index thereafter.