Our quarterly valuation review explores recent valuation trends in the public and private markets, directed to small and middle market business owners and the professionals and financial institutions that serve them. The review is designed to provide realistic guidance on the question “What’s it Worth?,” keeping in mind that proper preparation for real world transactions requires analysis of specific situations based on up-to-date data.

Executive Summary

U.S. private equity deal activity continued to experience robust market activity during 2016, subsiding only slightly due to increased competition from strategic corporate acquirers. With large corporate cash balances and inflated stock prices, strategic acquirers can move quickly and justify synergistic pricing. The lower middle market (LMM), which is often less competitive and lacks the strategic acquirer interest, continues to experience increased deal flow. Private equity deal value in the LMM increased 21% in 2016 as private equity firms continued to chase smaller deals. Transaction multiples remained elevated and buyers continued to utilize significant levels of debt to fund acquisitions. At PW&Co, we continue to see improvement in businesses looking to grow – raising growth capital or expanding through acquisition – a positive sign for the Alabama economy.

Valuation Multiples in M&A Deals

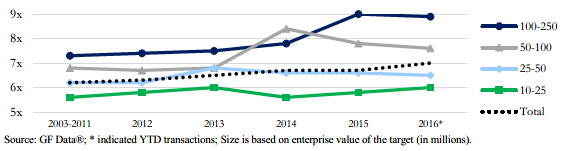

Multiples of middle-market companies (defined here as companies with transaction values between $10M and $250M) continued to remain strong in 2016; however, multiples in the largest size categories dipped slightly while the lower-middle market businesses continued to surge, as shown in Figure A below. As shown in the figure below, middle-market companies sold to financial buyers for an average of 6.9x trailing 12-month EBITDA during 2016, a 0.2x (~3%) increase from 2015 levels.

Figure A: Valuation Multiples in Middle-Market M&A Deals by Size [i]

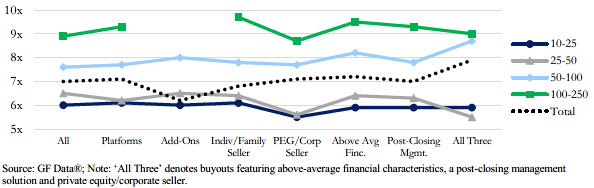

As shown in Figure B below, value is driven by a variety of factors, including existing ownership (individual/family or institutional), transaction purpose (platform or add-on), financial characteristics, and continuation of management post-closing. In almost all of these categories, private equity buyers have paid a “size premium” for larger businesses over comparable smaller ones. At the lower end of the middle market with enterprise value less than $25 million, sellers appear to be getting a premium for relative value factors compared to larger deals.

Figure B: Valuation Drilldown: Private Equity Buyout Multiples in 2016 [ii]

Publicly Traded Valuation Multiples

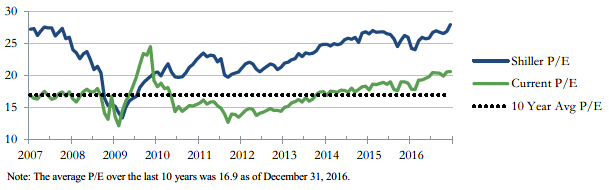

Private transaction multiples are the most direct evidence of valuations in the private markets. However, public markets also provide an important view of valuation metrics and show how sophisticated investors currently view and quantify risk in a given company, industry, or geography. The current P/E ratio (current price divided by latest 12-month earnings) of the S&P 500 index increased throughout 2016 and the Shiller P/E ratio (current price divided by average earnings over 10 years) increased to 27.9 from 26.0 over the same time period.

Figure C: Publicly Traded Valuation Multiples Over Last 10 Years [iii]

Debt Markets

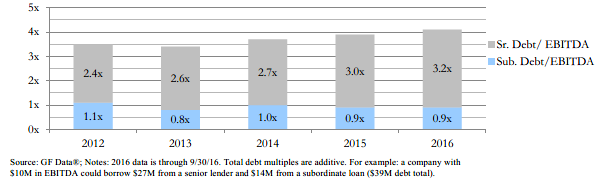

Debt utilization remained elevated in 2016, helping private equity firms fund expensive transactions at current deal prices. Total leverage for add-on transactions averaged 4.6x EBITDA (compared to 3.8x EBITDA for platform acquisitions), as acquirers used their existing company’s financials to obtain increased levels of debt. Senior debt pricing averaged 4.7% (3.7% spread over 90-day LIBOR) in Q4 2016, a slight decrease from 2015 levels, and subordinated debt interest rates averaged 11.5% (14.5% all-in, including PIK and warrants) in 2016.[iv] The figure below summarizes the change in leverage ratios over the past five years.

Figure D: Debt Multiples [v]

Conclusion

Business owners often have a significant amount of their net worth tied to their own businesses. When evaluating business options (expansion opportunity, company sale, ESOP feasibility, succession plan, etc.) a business valuation is often a good place to start. At PW&Co, our expertise in valuation allows us to advise clients on valuation issues in connection with the sale of companies and informs our advice on the process by which they are sold. When selling an entire company, we advise clients to look for synergistic and industry buyers who can realize the greatest benefits from the acquisition, and thus pay the highest price for the company. Regardless of market conditions, successful liquidity events take preparation and time. We encourage our clients who are considering the sale of their business, raising debt or equity capital for growth, evaluating succession plan options, or contemplating how to put their capital to work most effectively to contact us to discuss how to prepare in advance to achieve the best possible outcome.

Information in the above report should not be reproduced in any manner or used in work product without written permission from the data source or from PW&Co.

[i] Figure A. Source: GF Data®, M&A Report, February 2017.[ii] Figure B. Source: GF Data®, M&A Report, February 2017.

[iii] Figure C. Source: Bloomberg, accessed 2/15/17, Robert Schiller, http://www.econ.yale.edu/~shiller/data/ie_data.xls.

[iv]Source: GF Data®, Leverage Report, February 2017.

[v] Figure D. Source: GF Data®, Leverage Report, February 2017.