Earlier this summer, the House of Representatives passed the SECURE Act (“Setting Every Community Up for Retirement Enhancement”) with bipartisan support and a nearly unanimous vote. As of the writing of this commentary, it stalled in the Senate, but reports show bipartisan support there as well. The proposed legislation (“the Act”) can be considered to have two general areas of impact: (1) mandated and incentivized changes to retirement plan design, and (2) changes to mandatory withdrawals from IRAs and retirement plans for both individuals and their beneficiaries. These proposed changes are summarized below. If the proposal becomes law, IRA and 401(k) owners should examine their current estate plan and beneficiaries with an expert as the tax impacts can be substantial.

I. Changes to Retirement Plan Design

The proposed changes in retirement plan design are intended to reduce regulation for plan sponsors, making it easier to start a plan for employees, and they offer expanded options for participants. The summary here is intended to be brief but to outline opportunities and impact for more discussion.

- Removes Barriers from Plan Design for Participants

- Better access to multiple-employer plans, potentially increasing access for small business owners and their employees by lowering costs and reducing fiduciary concerns

- More flexible safe harbor rules and plan adoption rules

- More tax credits for start-up plans and for providing automatic enrollment

- Options for Participants

- Increased annuity options inside plans

- More inclusion for part-time employees

- Change in the Required Minimum Distribution age from 70.5 to 72

- Penalty-free distributions to cover costs for the birth or adoption of a child

II. Changes for IRA and Retirement Plan Account Owners

While the proposed changes to retirement plan design will have an impact on individuals planning for retirement, perhaps the largest impact will be on those individuals who have accumulated a large balance in a retirement account that will be inherited by heirs in the future.

1. Individuals

Currently, an IRA owner accumulates savings and investment gains tax-deferred throughout her life. At the age of 70.5, the owner is required to begin taking out required minimum distributions (“RMD”) based on her age and the IRS uniform lifetime tables. This distribution is taxed at ordinary income rates. The proportion of the account that must be withdrawn increases with age. At age 70.5, the owner must withdraw 3.64%; at age 85, the owner must withdraw 6.75% of the account.

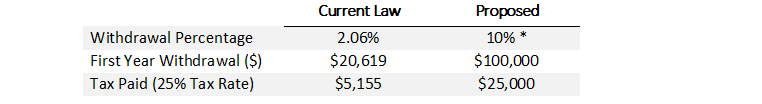

Under current law, once the original owner passes away, the beneficiary of the account is now able to “stretch” the withdrawals over her own lifespan. For example, a 35-year-old who inherits $1,000,000 will need to withdraw 2.06% of the account.

The Act proposes that the beneficiary of an inherited IRA must withdraw all funds from the account within ten years, eliminating both the RMD and the ability to stretch payments to continue tax-deferred growth. This also applies to Roth IRAs, but these withdrawals are not taxed. Table 1 illustrates the effect of the change.

Table 1: A 35-year-old Inherits a $1,000,000 IRA

* Note – the Act mandates that the money be withdrawn completely and taxes paid within ten years. In this example, the first-year withdrawal is simply illustrated 10% of the account.

Of special note are the exclusions to the 10-year payout rule. Eligible beneficiaries would be allowed to continue with the current stretch provisions, and these beneficiaries include:

- Surviving Spouse

- Minor children up to the age of majority (but not grandchildren)

- Disabled individuals

- Chronically ill individuals

- A beneficiary not more than 10 years younger than the IRA owner

2. Trusts

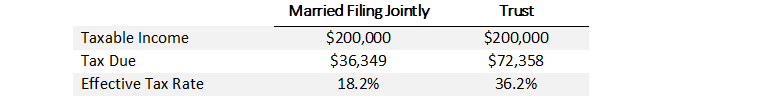

Trusts as beneficiaries stand to be heavily impacted because of the compressed tax rate schedule. Trusts reach the top bracket of 37% at only $12,750 of income, while married filing jointly do not reach it until $612,350 of income, a stark difference. As is evident in Table 2 below, a larger mandated withdrawal from an IRA results in a significantly higher tax burden. An IRA owner would have to balance the asset protection features of the trust with the heavy tax impact and may want to consider other assets to fund a trust.

Table 2: Trust Income Taxation vs. Individuals

III. Actions to Consider

IRA owners should examine their estate plan if the Act is signed into law. Listed below are a few possible modifications and strategies to manage the tax impact.

- Consider Roth conversions each year during life while managing your tax bracket.

- Consider charitable bequests by directly naming a charity as a beneficiary (and leaving other assets to your heirs).

- Re-think beneficiaries especially trusts and younger beneficiaries. With the exclusions listed above, a surviving spouse could have a longer stretch to withdraw from an IRA than a 25-year-old child or grandchild.

- Consider permanent life insurance to fund a wealth transfer instead of using IRA assets.

Ultimately, the actions will need to be considered as part of your overall financial plan and goals. Our firm helps individuals analyze their specific situation and make decisions like these as they plan for their financial future. For more information about our wealth management services and how we help solve financial problems, please visit our Wealth Management page.

Important Notes:

Investment management is offered through Porter White Investment Advisors, Inc., SEC-registered investment advisor.

This document is intended to raise issues for consideration by friends and clients. A number of simplifying assumptions have been made and details omitted for purposes of analysis. Consequently, readers are encouraged to seek competent tax counsel and not rely solely on any of the statements made herein.

Any advice concerning U.S. federal tax issues contained in this communication is not intended or written to be used for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or tax-related matter addressed herein.