After the SECURE 2.0 Act was signed into law at the end of 2022, we highlighted some of the implications for business owners and savers. One such highlight that we want to focus further on is the tax credits offered to small employers. While the original SECURE Act created tax credits for small employer plans, SECURE 2.0 significantly increases the available tax credits, including some that could cover the costs of offering a small plan for up to three years:

Start-Up Cost Tax Credit

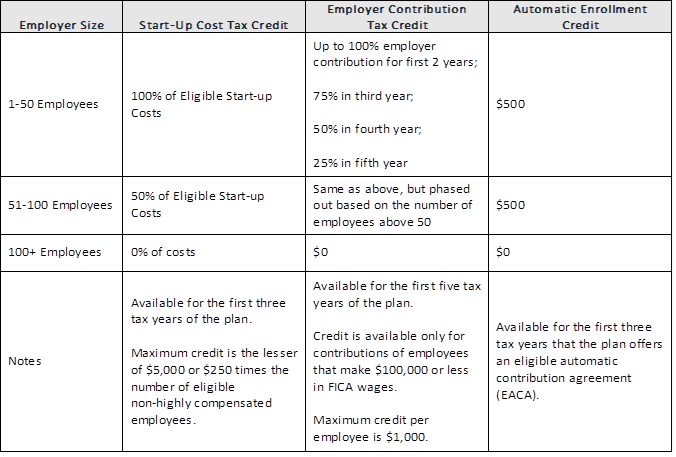

In many cases, the start-up cost tax credit can make it almost free for employers with 50 or fewer employees to start a plan. Employers are eligible for the tax credit if they had no more than 100 employees making at least $5,000 in the prior year and did not maintain a 401(a), 403(b), SIMPLE, or SEP plan in the three taxable years immediately preceding the tax year in which the plan is adopted.

Employers with 1-50 employees can get a 100% tax credit for start-up costs equal to the lesser of $5,000 or $250 times the number of eligible non-highly compensated employees. Employers with 51-100 employees can get 50% of the same maximum credit for eligible start-up costs.

“Eligible start-up costs” include costs to set up and administer the new plan and costs to educate employees about the new plan. This includes document fees, advisor fees, plan documentation fees, and other expenses necessary to establish the plan.

Note: The establishment costs in the year prior to the plan being effective could count as the first of the three years of eligibility.

Employer Contributions Tax Credit

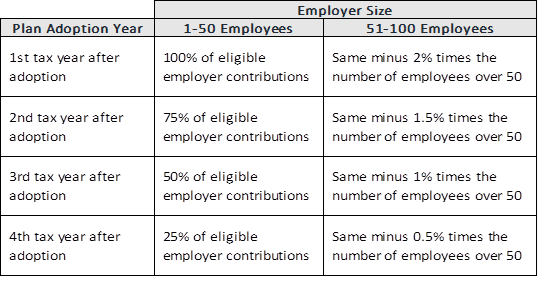

SECURE 2.0 also added a tax credit for small employers that make employer contributions to a new plan. An employer is eligible for a tax credit if the employer had no more than 100 employees making at least $5,000 in the prior year.

The maximum credit offered is the lesser of actual employer contributions, or $1,000 for each employee making $100,000 or less in FICA wages, at the following rates:

Automatic Enrollment Credit

The automatic enrollment credit encourages small businesses to include automatic enrollment features in their retirement plans. The credit is available for three years and can be claimed by employers with 100 or fewer employees who implement an eligible automatic enrollment arrangement (EACA). The maximum credit amount is $500 per year.

SECURE 2.0 requires plans established after December 29, 2022, to add an eligible automatic contributions arrangement to the plan no later than the 2025 plan year. Although this may be an additional administrative burden, the EACA feature will generate a tax credit for eligible small employers for the first three tax years in which the EACA feature is maintained.

Note: Unlike the start-up credit, there is no requirement that there be at least one non-highly compensated employee.

SECURE 2.0 provides great incentives for employers to establish a retirement plan that provides a lasting benefit to employees that will impact their ability to retire, which in turn can improve recruiting and retention. However, not all retirement plans are created equal, so do not hesitate to consult a financial advisor or tax professional to understand how SECURE 2.0 changes apply to your individual situation.