While following events closely during the second quarter of 2020 when our society shut down for almost a month and then started reopening, a few important investment themes emerged.

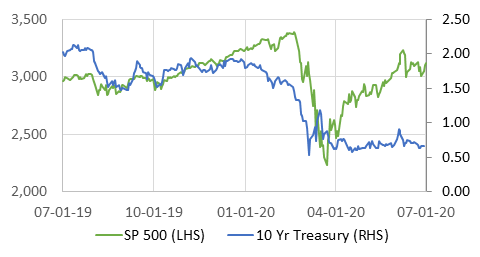

I. S&P 500 Recovered but Rates Stayed Low.

While the equity markets substantially recovered during the second quarter, and the S&P briefly traded in positive territory at the beginning of June, the 10-year treasury rate remained stubbornly low. Equity markets are more impacted by the near future, and treasury rates reflect longer term expectations of economic growth. While it is comforting that equity markets have bounced back, current longer-term interest rates are lower than they have been even during the fallout of the great recession of 2008-09. Now is a good time to reassess risk tolerance, while remembering that only in taking risk can we expect return.

II. Value Performed Poorly but Small Caps Closed the Gap.

Value stocks continued to underperform growth, and the price earnings multiple of growth stocks rose even higher during the quarter. The outperformance of small companies versus large companies masked some of the relative underperformance, perhaps because the market reflected an expectation of lesser adverse economic impact from Covid-19 on small companies. The technology industries were deemed to be better able to withstand the pandemic. The multiple of earnings that investors are paying for growth stocks, however, is higher than at any time since the dot com bubble of 1999-2000. Only relatively strong earnings growth will enable this story to end well for growth stock investors.

III. Markets Trade on News of a Vaccine, but Do We Already Have Something?

Any positive news of a vaccine trial that might help end this global pandemic has sent markets upwards. The FDA announced a very low bar for the efficacy of a vaccine: 1) it must have no serious side effects, and 2) it must be at least 50% effective. Don’t we have something already that is that effective? During the quarter, research on the widespread use of face coverings highlighted the early missteps made by infectious disease professionals who discouraged their use. Wearing masks may be more effective than early vaccines. We only need to look to South Korea and other countries that are better managing this pandemic. Not everyone in this country is willing to wear a mask or take a vaccine for that matter. How well we recover from this pandemic is dependent on both.

Important Note:

(a) Past performance is not a guarantee of future results.

(b) There is no guarantee that an investment strategy will be successful.

(c) Investing involves risks including possible loss of principal.

(d) Diversification and asset allocation do not ensure a profit and may not protect against market loss.

(e) The S&P 500 (or any index or factor) is not “investible” and not available for direct investment.

(f) Historical performance results for investment indexes, categories or factors, generally do not reflect the deduction of transaction or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.

(g) Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that a portfolio will match or outperform any particular index or benchmark.

(h) This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.