International stocks have significantly under-performed US stocks, recently. Investors with allocations to international stocks have watched them perform so poorly on a relative basis that they might question why they own them in the first place.

Since June 2008, US stocks[1] have earned ~9% per year where International stocks[2] have only earned ~2% per year. (For our discussion here, we include the returns of Emerging Markets Stocks in the international stocks starting when a published index reporting those returns was available in 2004.) In fact, if you had invested $100 in US Stocks in 1970, it would have grown to $12,140 by March 2018 whereas the same $100 invested in International stocks would have grown to only $7,505. As depicted in the graph below, most of this difference is due to the divergence in stock returns in the past 10 years.

Figure 1: Growth of $100 Invested in International and US Stocks

However, this graph which depicts dollars that haven’t been adjusted for inflation can be a little misleading. What we find more helpful is looking at the percentage change in the $100 investment over the time period to better analyze the impact on investors at various points in time along the way. To do this, we use the statistical technique of taking the logarithm[3] of the growth of $100 in each investment. This graph, with the exact same result at the end, is shown in Figure 2 below.

Figure 2: Growth of $100 Invested in International and US Stocks (Log Scale)

In Figure 1, the vertical axis represents a linear scale where each step along the line is equal. In Figure 2, the vertical axis is converted to a log-based scale of 10 which makes each equal step along the line 10 times larger: 50, 500, 5000, and so on. Since a dollar in 1970 is not worth the same as a dollar in 2018, the linear axis in Figure 1 limits the interpretation of the trends over time. Using a log-based scale for the vertical axis allows it to reflect the percentage change and provides a more informative depiction of relative performance over time.

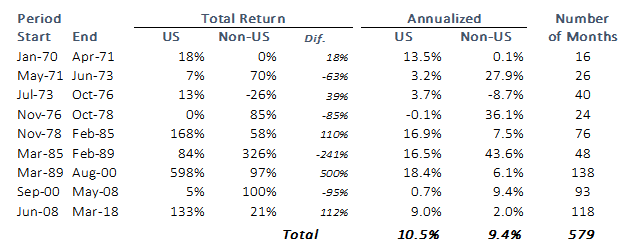

We can better see from Figure 2 that there have been periods of both under and over performance of international and domestic stock returns. These periods are better represented in the table below. The total return is calculated to find the largest divergence of each of the two investments as well as the length of time. These results allow us to make the following observations:

- The greatest outperformance of international stocks occurred from March 1985 until February 1989. This period lasted 48 months, and the growth of $100 for international stocks was 2.4x higher than US stocks.

- The greatest outperformance of US stocks is from March 1989 until August 2000 during the so-called “dot-com boom.” This period lasted 138 months and the growth of $100 was 5x higher for US stocks than international stocks.

- The current period of outperformance of US stocks is more similar to the period from November 1978 until February 1985, although that period was shorter.

Table 1: Periods of Over/Under Performance of International vs US Stocks

Another way to depict periods of over and under performance is shown in Figure 3 below, which is basically a graphical representation of the data in Table 1 above. From this we can make the following observations:

- The periods of outperformance of US stocks have been longer historically but not exceptionally different from non-US stocks, except during the Dot-Com boom.

- Since 1980, these periods have tended to last for a long period of time in both directions.

Figure 3: Periods of Over/Under Performance of International vs US Stocks

Note: Growth of a $100 reset at relative high/low inflection points between the domestic and international indices. Domestic: S&P 500 for the full period. International: MSCI EAFE from January 1970 through December 2003; MSCI ACWI ex USA from January 2004 through March 2018.

So where does this leave the average investor?

- The first, and most important word of caution, is that past performance is not necessarily an indication of future performance. We look at performance in order to put our current experiences in context. Our preliminary conclusion is that our current experience is not exceptional when compared to history. We need to resist making predictions about the future by looking only at recent performance.

- This analysis that focuses only on returns does not consider risk, volatility or the construction of a balanced portfolio. We believe that one of the primary reasons to invest in global stocks – both US and International – is to achieve better diversification in our investment portfolios. In order to achieve diversification, we should expect certain parts of our portfolio to outperform. A portfolio where everything performs the same cannot be well diversified.

- Finally, we need to be watchful about the way investment information is presented, particularly when looking at returns over a long period of time. The way Figure 1 is presented puts too much emphasis on the recent time periods and not a broad enough view of history.

It is important for all investors to assess their willingness to experience returns that are different from “the market,” where the “market” is whatever comes to the investor’s mind, frequently the S&P 500 for US investors. A good investment portfolio is one that an investor can stick with through all market environments and endure the inevitable differences in performance that comes from investing in a portfolio that is not identical to the investor’s perception of the “market.” Click here for a PDF version of this commentary.

[2] International represented by MSCI EAFE from January 1970 to December 2003 and MSCI ACWI ex USA from January 2004 to March 2018.

[3] A logarithmic scale is a nonlinear scale used when there is a large range of quantities. It is based on orders of magnitude, rather than a standard linear scale, so the value represented by each equidistant mark on the scale is the value at the previous mark multiplied by a constant. In this case, the constant is 10.

Important Notes

(a) Past performance is not a guarantee of future results.

(b) There is no guarantee that an investment strategy will be successful.

(c) Diversification and asset allocation do not ensure a profit and may not protect against market loss.

(d) The S&P 500 (or any index) is not “investible” and not available for direct investment.

(e) Historical performance results for investment indexes, or categories, generally do not reflect the deduction of transaction or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.

(f) Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that a portfolio will match or outperform any particular index or benchmark.

(g) This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

(h) Porter White & Company (“PW&Co”) is a trade name for a group of companies offering financial services that include both regulated and un-regulated affiliates. Investment advisory services are offered by Porter White Investment Advisors, Inc., an investment advisor registered with the SEC.