According to the National Philanthropic Trust,[1] approximately 90% of high net worth families give to charity, and in 2017, charitable giving accounted for 2.1% of gross domestic product. American families have historically given more money to charity than those in other countries, and charitable giving has become a fabric of our culture, a way to articulate and transfer family values, and a way to take advantage of the tax benefits made available to donors.

In the context of an overall financial and investment plan, how do individuals decide how much money to give to charity? What amount and method accomplishes their charitable goals? How much can one give to charity without sacrificing long term goals like retirement income, education planning, or bequests to family members.

As with most financial and investment planning, a disciplined plan and approach is beneficial here as well.

I. Integrating Charitable Giving in your Financial Plan

If you do not have a plan or a goal, you’ll never reach it. We often ask our clients, “What is this money for?” At first, it may be difficult to articulate. With some guiding, clients may find their goals to include one or some of the following:

- Provide income in retirement,

- Provide enough money so that neither spouse has to live in an institutional setting for long-term care,

- Provide for children’s or grandchildren’s education, or

- Provide a specific amount of money for heirs or a charity.

Through further analysis, a client may find that one goal has a high probability of achievement with the current savings, spending, and investments, but other goals have a lower likelihood. What “levers” can be adjusted to accomplish the charitable giving goal? Does current giving need to be adjusted to increase the likelihood of meeting the retirement income goal? Do you have a priority for giving while you are living over a bequest at the end of life?

According to a study by the Lilly Family School of Philanthropy,[2] slightly less than half of wealthy respondents have a giving strategy and a giving budget. Those who consider themselves “knowledgeable” or an “expert” about charitable giving are much more likely to have a strategy and a budget. 37% of respondents said that they have difficulty understanding how much they can afford to give.

II. Ways to Conceptualize Giving

A. Maximizing Tax Benefits

Charitable giving not only helps those who receive the funds but also the donor by providing a tax benefit. Depending on the type of gift (cash, securities, company stock, real assets, etc.) and the recipient (501(c)3 or private foundation), a donor can receive a tax deduction against income and potentially the exclusion of capital gains. While the specific details will not be discussed here, individuals may choose to focus on the tax impact as the primary driver.

For example, if an individual is diversifying her portfolio from a single concentrated stock holding as she enters retirement to reduce risk, she may make a substantial charitable gift in that year to reduce the tax impact. While we do not recommend letting taxes be the “tail that wags the dog,” the implications can be sizeable, especially for large taxable events.

B. Giving a Percentage of Income

One way to create a discipline of charitable giving is to decide upon giving a percentage of income. When a person is in accumulation mode while working, possibly raising a family, and saving for retirement, this framework may make the most sense. As income hopefully grows through time, charitable giving will grow as well. This method could also be appropriate for someone with investment income.

Several religious traditions suggest giving 10% to the church or to the poor, which some may choose for their benchmark. On average, residents in Alabama give 4.9% of their adjusted gross income to charity, trailing only Mississippi (5.0%) and Utah (6.6%).[3]

C. Asset Approach

For a person or family with sizeable investment assets, the approach could be similar to that of a private foundation or a non-profit endowment with a spend rate based on the value of the assets. A private foundation needs to give away 5% annually to avoid tax consequences. Based on your assets and goals, a lower rate may be more appropriate. If a family plans for a 5% withdrawal rate on their assets, they might consider a percentage of this withdrawal as their target. (i.e., 10% of a 5% withdrawal would be a charitable budget of 0.5% of assets per year.)

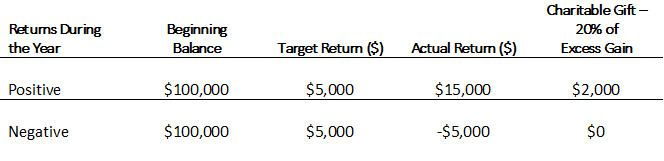

D. Giving a Portion of Gains

Another way to structure giving is to gift a portion of investment gains in years that excess return is earned. This method could be used in addition to the income or the asset approach or as a standalone method. For example, if your target return goal is 5% per year, and your investments earn 15% in one year, you could allocate a specific portion of that additional gain. In years that returns were lower, charitable gifts would not be made. An example is shown in Table 1.

Table 1: Excess Gains Method

III. Conclusions

Regardless of the method that is appropriate for you and your family, having a structure and a plan will be beneficial over the long term. Giving now can potentially take away from funds available in the future and needs to be considered in the context of your overall financial goals and plan.

Our firm helps individuals analyze their specific situation and make decisions like these as they plan for their financial future. For more information about our wealth management services and how we help solve financial problems, please click here.

This document is intended to raise issues for consideration by friends and clients. A number of simplifying assumptions have been made and details omitted for purposes of analysis. Consequently, readers are encouraged to seek competent tax counsel and not rely solely on any of the statements made herein.

Any advice concerning U.S. federal tax issues contained in this communication is not intended or written to be used for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or tax-related matter addressed herein.

[2] https://scholarworks.iupui.edu/bitstream/handle/1805/17667/high-net-worth2018.pdf accessed March 27, 2019

[3] https://www.philanthropyroundtable.org/almanac/statistics/u.s.-generosity accessed March 27, 2019