Overview

Porter White & Company (“PW&Co”) reviewed almost 4,000 community bank M&A transactions since 2001 to ascertain the impact, by county, of county economic standing (as measured by GDP) on deal activity and transaction pricing. We believe this analysis may be useful as Alabama banks work through the economic impact of the COVID-19 pandemic. A summary of our findings and strategy follow.

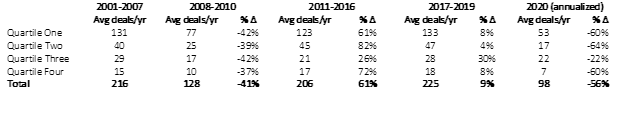

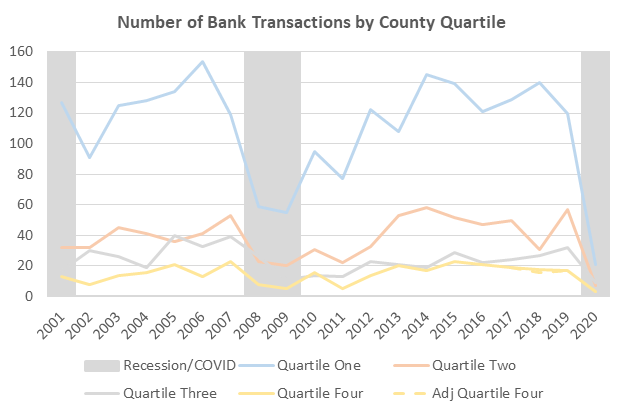

- The economic cycle drives M&A across all counties, regardless of economic standing. COVID-19 has dramatically slowed 2020 deal volume.

- When ranking transactions by the economic standing of the headquarter counties of the target, top quartile counties represent the bulk of M&A activity in all economic cycles as they represent 80% of the nation’s GDP.

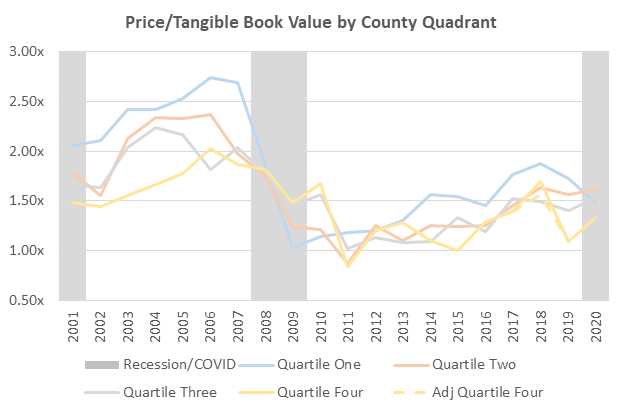

- Top quartile counties have more M&A pricing volatility than deals in smaller GDP counties and have valuation premiums as compared to lesser GDP counties in good times. Such valuation premiums tend to disappear in recessions.

- In good economic times, banks headquartered in smaller GDP counties with a branch presence in larger GDP counties receive M&A premiums similar to banks headquartered in large GDP counties.

Given the above, we believe bankers should consider the following M&A strategies during and after the current COVID-19 induced recession.

- Large GDP county banks should consider avoiding sell-side activity until the economy improves. Well capitalized large GDP county banks may consider purchasing other large GDP county banks at a COVID-19 discount or consider stock transactions.

- Smaller GDP county banks who wish to sell may receive a COVID-19 based “low ball” offer below the 1.00x-1.30x Price/Tangible book these banks typically receive.

- Well capitalized smaller GDP banks should consider expansion into higher growth counties, either de novo or through purchase of divested branches from larger banks, as these assets could improve the banks’ Price/Tangible book multiple.

National M&A Activity Since 2001

PW&Co utilized databases from S&P Global Market Intelligence and the Bureau of Economic Advisors to analyze the impact of the local economy on 3,848 Community Bank M&A transactions across the nation since 2001. The S&P database contained deal multiples and the target bank’s headquarters location by county. The BEA data provided GDP information by county. We ranked each county in each state by GDP size for every year from 2001-2018 and assigned each county a quartile designation. Counties which produced the top 25% of a state’s GDP in a given year were in Quartile One for that year, counties producing 25-50% were in Quartile Two, etc. We then matched target banks headquarter counties with GDP quartile ranking, resulting in an ability to assess GDP impact on deal volume and pricing. Our findings are summarized in the graphs and charts below.

Rationale for our Analytical Conclusions

Chart Two and Graphs One and Two confirm the four analytical conclusions highlighted in the introductory paragraph. Chart One below provides context for these charts and graphs.

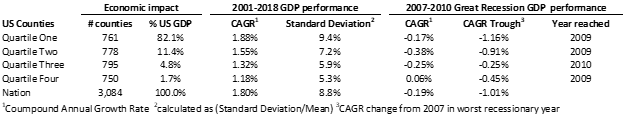

Chart One: County Quartile GDP Activity

The importance of the Quartile One counties is evident from the above as they represent 80% of the nation’s GDP and carry the highest growth rate. These factors support why these bank’s carry M&A premiums in good times…they are direct beneficiaries of the nation’s economic growth.

Chart One also conveys the impact of GDP volatility on our Quartile analysis. Please note the volatility, as measured by standard deviation, of Quartile One M&A is 7% higher than the nation, and 77% higher than Quartile Four. This is evidenced by the GDP performance of the Quartile One in the Great Recession. Due to spec residential construction, sub-prime mortgages and higher levels of leveraged lending, GDP reduction in the Great Recession was nearly 3.3x higher in Quartile One versus Quartile Three and Four, which helps explain Quartile One pricing volatility versus Quartile Three or Four.

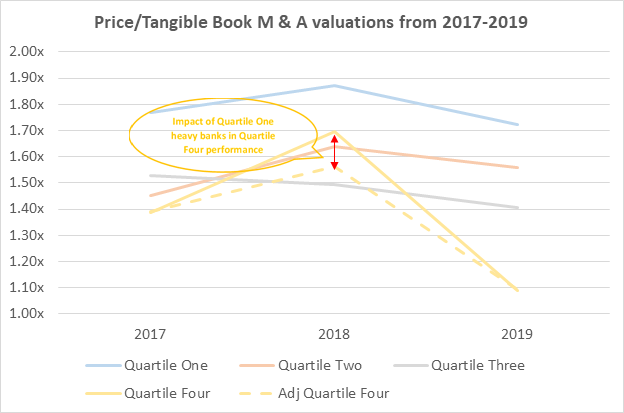

Graph One: Community Bank M&A Transaction Pricing by County Quartile

Despite the GDP inspired M&A pricing volatility, Chart Two and Graph Two reflects that GDP impacts all areas of the economy, regardless of county specific GDP productivity. Although the swing in deal volumes in Quartile One look larger than the other quartiles, remember that Quartile One starts from a much larger base, and that actual percent change in quartile deal volume is nearly identical.

Chart Two: Deal Volume by County Quartile 2001-2020

Source: S&P Global Market Intelligence

Graph Two: Community Bank M&A Transaction Volume by County Quartile

Source: S&P Global Market Intelligence, National Bureau of Economic Research

M&A Strategies in a COVID-19 Recession

Of the three strategies mentioned, the first two strategies seem evident from the graphs and chart above. Our discussion will focus on the third strategy involving Quartile Three or Four banks establishing branch presence in Quartile One counties.

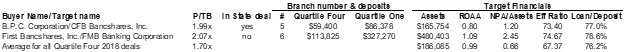

While performing our research, we noted several Quartile Four bank sales in 2018 with Price/Tangible Book sales prices in the 1.90x – 2.00x range. These transactions typically involved banks with asset size $200-$500mm, and 5-7 branches with headquarters in Quartile Four counties. However, these banks were adjacent to Quartile One counties, and those Quartile One counties held the bulk of the bank’s branches and assets. Hence, the Quartile One type valuation.

The transactions illustrated by the red circle in Graph One are reflected in Graph Three and Chart Three below. Graph Three reflects a detailed view of the period highlighted by the red circle in Graph One.

Graph Three: High Multiple 2018 Quartile 4 Sales

The actual 2018 Quartile Four Price/Tangible Book ratio was based on 18 sell-side deals and reflected a very healthy 1.70x Price/Tangible Book ratio. We adjusted the 2018 Quartile Four transactions by deleting two richly priced transactions that were clear outliers from typical Quartile Four sell-side multiples. This reduced the adjusted Quartile Four ratio to 1.56x. As mentioned earlier, the common link between the two transactions which drove the 1.70x actual Quartile Four ratio were size (both transactions involved 5-6 branch franchises) and location (headquarters branch in a Quartile Four county, with sister branches in adjacent Quartile One counties). These transactions are detailed below:

Chart Three: Outlier 2018 Quartile Four Transactions

Source: S&P Global Market Intelligence

These deals could serve as a template for Quartile Three and Four banks in today’s Alabama bank market. The COVID-19 environment may reduce asset values in Quartile One counties. Many Alabama Quartile Three and Four banks have abundant capital to purchase these assets, and low loan/deposit ratios to support growth in those assets. This could be a winning combination for our state.

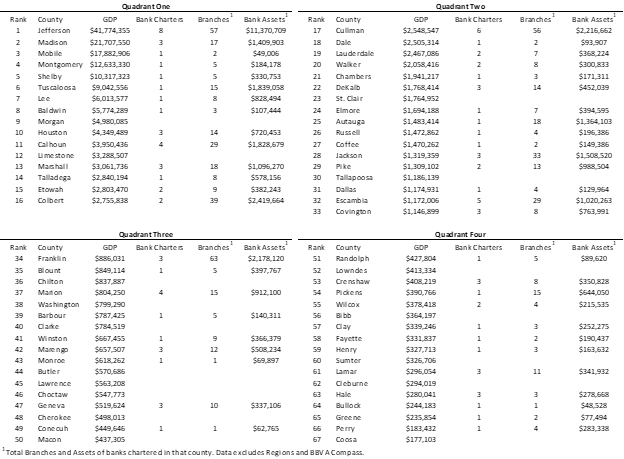

The following chart illustrates Quartile metrics for the state of Alabama. Using the analytical process outlined above, this could be a useful tool as your bank assesses the potential M&A/branch expansion landscape considering COVID-19. Call Mike Murphey at 205-252-3681 with any questions or comments.

Chart Three: Alabama County Quartile Rank Based on 2018 GDP

Source: BEA, S&P Global Market Intelligence

This is a publication of Porter White Capital Advisors, Inc., a non-regulated entity.