In order to make sound investment decisions today, we are forced to make long term projections of portfolio returns. The methodology, assumptions, and original inputs for our approach to predicting long term portfolio returns are originally documented in our white paper titled, Projecting Long Term Portfolio Returns[1]. This paper updates the original with data as of December 31, 2018. Using the same methodology, the expected return for a balanced portfolio increased by 0.92% to 7.37% at the end of 2018, or 5.56% after inflation.

I. Risk

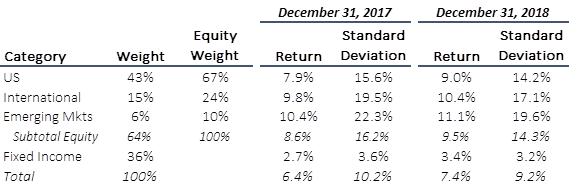

Modern Portfolio Theory relies on volatility of prices as a proxy for risk and derives estimates of volatility from representative indexes. For the representative indexes, we updated the standard deviations and correlations using the last 10 years of index data. Overall, across the major asset classes – US, International, Emerging Markets, and Bonds, correlations slightly decreased.

II. Bond Returns

We assume that the current yield on the 10-year Treasury equals the return earned on Treasuries over the next 10 years. For non-Treasury securities, we also adjust for the credit risk using the current spread in yields between comparable duration treasuries and corporates. We updated the 10-year Nominal and TIPS Treasury yields as well as the indexes representative of corporates, and their corresponding correlations. The 10-year Nominal Treasury yield increased from 2.40% to 2.69% during 2018. The 10-year TIPS yield increased from 0.44% to 0.98%. The assumed credit spread in yield attributable to corporates increased from .83% at 1.19%[2]. The Federal Reserve reports that its latest estimate of 10-year expected inflation is 1.71%.[3] International yields on a dollar-hedged basis became much more attractive relative to US treasuries.

III. Equity Returns

For the purposes of our projection, we consider the size and value factor premiums. Our resulting model for the expected return on equity is:

E[Equity Return] = Risk Free Rate + Market Factor + Factor Premium

A. Risk Free Rate

We assume that the Risk Free Rate should be the yield on US Treasury security with a maturity equal to the investor’s time horizon, but not greater than 10 years. The 10-year Treasury yield is the assumed risk-free rate and was updated from 2.40% to 2.69%.

B. Market Factor

The combination of Beta and the Equity Risk Premium is often referred to as the “Market Factor”. We continue to assume beta is 1.0 for all classes other than utility stocks where we use Damodaran’s estimated beta of 0.7.[4] For equity risk premiums, we use Damadoran’s implied equity risk premium approach. Using updated Damadoran equity risk premiums and credit ratings for US, Emerging Markets, and EAFE, expected returns dropped. The US premium increased from 5.08% to 5.96%. The international premium increased from 5.59% to 6.29%. The emerging markets premium increased from 6.74% to 7.67%. The country risk premium went from 1.12% to 1.23%.

C. Factor Premiums

Our model considers the size and value factor premiums. We use long term historical averages as the best predictors of the future. As such, we updated the historical annualized return and standard deviation for our representative portfolios in US, international developed, and emerging markets. The current price-to-book and weighted market cap figures were updated for the representative portfolios and indexes.

IV. Return Comparison

For a global diversified portfolio of 64% equities and 36% fixed income we project as of December 31, 2018, a 10-year annualized portfolio return of 7.4%, compared to a return of 6.4% as of December 31, 2017. Changes to the projected returns from 2017 to 2018 are primarily driven by a shift from domestic to global fixed income over the past year, and an increase in expected equity returns comparable to those from 2016.

Important Notes:

- Past performance is not a guarantee of future results.

- There is no guarantee that an investment strategy will be successful. Investing in factors such as small cap and value may not realize expected returns over long time periods.

- Diversification and asset allocation do not ensure a profit and may not protect against market loss.

- Investing in factors such as small cap and value may not realize expected returns over long time periods.

- Historical performance results for investment indexes, or categories, generally do not reflect the deduction of transaction or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results.

- Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that a portfolio will match or outperform any particular index or benchmark.

- This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service.

- Porter White & Company (“PW&Co”) is a trade name for a group of companies offering financial services that include both regulated and un-regulated affiliates. Investment advisory services are offered by Porter White Investment Advisors, Inc., an investment advisor registered with the SEC. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission.

[2] As measured by the CSI A Index

[3] https://fred.stlouisfed.org/series/T10YIE

[4] Damodaran, Aswath. Damodaran Online, January 5, 2018, http://www.damodaran.com.