After the Employee Retirement Income Security Act (ERISA) of 1974 created the IRA, retirement savings options expanded for Americans, typically allowing for tax-deferred savings. While the benefits of these tax-deferred vehicles are enormous, they also come with strings attached. After reaching age 70½, individuals must withdraw a portion of the account and pay income taxes on the amount, regardless of whether or not they currently need the money. These rules can potentially create issues (and large tax bills) for those who have income sources elsewhere in retirement.

With the advent of the Roth IRA and subsequently the Roth 401(k), savers are now able to put after-tax money into an account that grows with no taxes on earnings. Unlike the mandatory withdrawal rules of traditional retirement accounts, money in a Roth account never has to be withdrawn (during the individual’s life) and is not taxed if it is withdrawn.

I. How does a Roth 401(k) compare to a traditional option?

In Table 1 below, the major differences between the two types of accounts are outlined. In general, Roth accounts offer more flexibility but do not offer a current tax deduction when money is contributed to the account.

Table 1: Comparison between traditional and Roth

| Traditional 401(k) | Roth 401 (k) |

|---|---|

| Receive current tax deduction on contributions | No tax deduction on contributions |

| Taxable upon withdrawal | Tax-free upon withdrawal |

| Required withdrawals at 70 1/2 | Never required to withdraw |

| Penalized on withdrawals before age 59 1/2 | Penalized on withdrawals before age 59 1/2, but not on the portion contributed (if allowed by plan) |

II. Three Scenarios

A Roth account may not be appropriate for everyone, and unfortunately, part of the answer lies in the ability to predict future tax rates, something no one can do! The three scenarios below show potential benefits (and shortcomings) of contributing money to a Roth at various future tax rates. All scenarios assume that the Roth contribution is decreased by the amount of taxes paid up front and that the money grows with a return of 5% annually in each account.

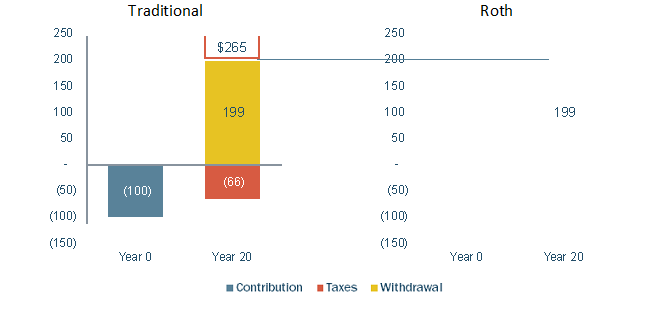

A. Constant Tax Rate

As Figure 1 shows, $100 dollars is contributed into a traditional IRA account. It grows to a total of $265, but upon withdrawal, taxes of $66 reduce the net amount to $199. For the Roth account, there is no deduction so $25 of the $100 goes to pay taxes and $75 is invested. This $75 grows to $199 (assuming the same investment returns) but is not taxed when withdrawn in year 20. The after-tax outcome is equal for both traditional and Roth contributions. While a larger contribution ($100) is made initially to the traditional account, less total taxes are paid from the Roth account.

Figure 1: Constant Tax Rate of 25%

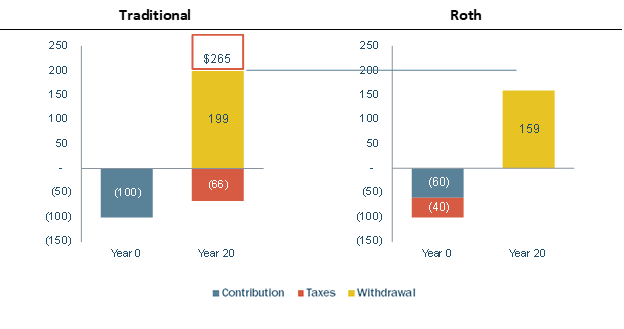

B. Higher Tax Rate Now – Traditional Likely Better

Many older workers in their peak earning years will be in a higher tax bracket in the years leading up to retirement and a lower tax bracket when they retire. Figure 2 shows the outcome of this example, resulting in the participant having a lower ending balance in the Roth account, even after taxes are paid on the traditional account. Without considering other benefits of a Roth, the traditional may be more beneficial if you anticipate being in a lower tax bracket in retirement.

Figure 2: Tax Rate of 40% in Year 0 and 25% in Year 20

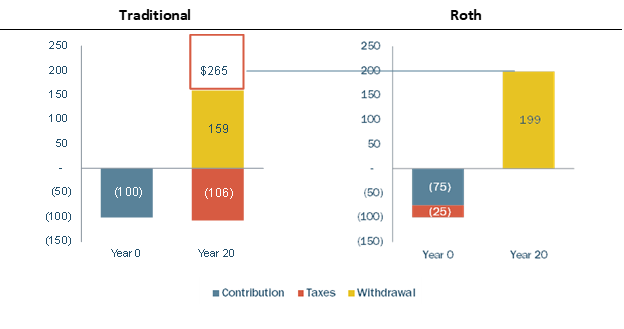

C. Higher Tax Rate in Retirement – Roth Likely Better

The third scenario below shows the effect of a worker being in a lower tax bracket now (possibly a younger employee) who would be in a higher bracket in retirement, whether the increase is the result of changes in the tax code or higher actual income. The Roth contribution is taxed at a much lower rate and results in a higher after-tax balance than the traditional account.

Figure 3: Tax Rate of 25% in Year 0 and 40% in Year 20

III. Conclusions

Although we cannot arrive at a definitive answer about which option is best, hopefully the three scenarios have helped to outline the pros and cons of the options. There are several rules of thumb when considering a Roth option.

- Having money in both types of accounts offers an advantage. If you are uncertain about future tax rates, having the option to draw from either a Roth or traditional account in retirement may have some value. Employer contributions will automatically be traditional savings, so if your employer contributes as well, you will always have some traditional savings.

- If you are maximizing your contribution ($17,500 in 2014), you can effectively increase your contribution by paying taxes with other earnings.

- Some plans also allow in-plan conversions of traditional savings to Roth. This action is taxable as income and is best executed in a year of lower taxable income and when taxes can be paid with earnings outside the retirement plan.

- Remember, the IRS can always change its mind! The benefits of a Roth account may not be available in the future, so having savings in both types can act as a hedge.

At Porter, White & Company, we help individuals analyze their specific situation and make decisions like these as they plan for retirement. For more information about our wealth management services and how we help solve financial problems, please visit our Investment Management Overview.

This document is intended to raise issues for consideration by friends and clients. A number of simplifying assumptions have been made and details omitted for purposes of analysis. Consequently, readers are encouraged to seek competent tax counsel and not rely solely on any of the statements made herein.

Any advice concerning U.S. federal tax issues contained in this communication is not intended or written to be used for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or tax-related matter addressed herein.