I. Overview

We are frequently asked by clients if they should pay for IRA related fees out of their IRA account or out of their checking account. At first, the answer appears simple: why would someone want to effectively reduce their IRA contribution by the amount of the fee deducted from the account? It turns out that the answer is more complicated.

The most important consideration is whether or not the fee would be deductible for income tax purposes. If it is deductible, then our initial answer (pay out of a checking account) is correct. If the fee is not deductible, then we need to consider other factors, such as the expected return on investments held in various accounts. Given the changes over time in tax provisions, expected returns, and other relevant considerations, investors need to consider what the right answer is for them based on their current circumstances, keeping particularly in mind that these circumstances may change once they enter retirement.

II. Tax Considerations

The IRS allows IRA investment management fees to be paid from within the IRA itself or from an outside taxable account. According to Section 212 of the Internal Revenue Code, fees are deductible as long as they are paid for managing investments that produce taxable income. However, because they are viewed as a miscellaneous deduction, they are subject to the 2% of AGI floor. They may also be further reduced by the Pease Limitation.[1] Finally, taxpayers may be hit by AMT, which requires the deduction of investment management fees to be added back to taxable income.

III. Analysis

A. Model

To help answer the question of how to pay an advisory fee, we constructed a model that included an IRA and a taxable account. Based on reasonable savings and return assumptions, we calculated the growth in value over time under the alternative assumptions of paying the fee out of the IRA and out of the taxable account. Clearly, the method that leads to the highest total wealth at retirement (and maximum after-tax disbursements during retirement) is preferred.

B. Key Assumptions

1. Returns

We made reasonable assumptions for returns in the accounts. To the extent that both taxable and tax deferred accounts are invested the same way, they would earn the same returns. If one account were merely a checking account (and didn’t earn much in interest), paying fees from this account could have a lower “opportunity cost” impact.

2. Deductibility of Fees

The ability of an investor to deduct a fee (and thus pay lower taxes) is a key assumption. Since deductibility is reduced for higher earners, the amount of deduction could change over time.

IV. Results

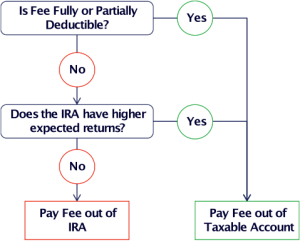

Our analysis showed that the assumption regarding the deductibility of the fee was the most important factor. If an investor can deduct the fee (or even only 1/3rd of the fee under a phase out scenario), then it makes sense to pay the fee out of the taxable account.

Even if a fee is NOT deductible, we found that investment returns are important. Paying a fee out of an account with a high expected return has a high opportunity cost because payment of the fee reduces the balance earning the return. Looking at various return scenarios, we found that if the return in the IRA is 3 to 4% higher than the return in the taxable account, it makes sense to pay a fee out of the taxable account, even if the fee is not deductible.

Figure 1: Decision Tree

V. Conclusion

For most savers, our original intuition leads us to the correct answer most of the time: investors should pay IRA related investment management fees out of accounts where income is taxable and expenses are deductible. However, the conclusion may change in retirement if the returns on IRA accounts are reduced as a result locating low risk, low return investments in retirement portfolios. Locating higher risk, higher return investments in taxable accounts and capital gains taxes can further change the answer. These considerations must be offset by the increased ability of an investor to take a deduction for fees when the investor enters retirement.

Taxes are inevitable. We try to help our clients maximize the advantages of tax-deferred accounts, while maximizing tax deductions and minimizing opportunity costs.

Author Note: Special thanks to Matthew Kerr, a candidate for the MSF and MBA degrees at the University of Alabama, for crunching most of the numbers required for this article.

This document is intended to raise issues for consideration by friends and clients. A number of simplifying assumptions have been made and details omitted for purposes of analysis. Consequently, readers are encouraged to seek competent tax counsel and not rely solely on any of the statements made herein.

Under requirements imposed by the IRS, we inform you that, if any advice concerning one or more U.S. federal tax issues is contained in this communication (including any attachments), such advice was not intended or written to be used, and cannot be used, for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or tax-related matter addressed herein.

[WMC 5]