Research has shown that selection of asset classes is the most important factor in determining the variation in returns of an investment portfolio across time and among portfolios.[1] This paper reviews PW&Co’s approach to selecting asset classes for inclusion in portfolios.

I. Defining Asset Classes

An asset class is a combination of securities that collectively provide a specified contribution to an investor’s portfolio in terms of risk, return and covariance of return with other asset classes. The asset class paradigm accommodates diversification at two levels: (i) a large number of securities are included within each asset class, and (ii) multiple asset classes are available for the formation of portfolios. Defining an asset class usually requires observation and analysis of the historic investment performance of securities, and this in turn requires continued observation and analysis because there is always the possibility that an asset class may become unstable and not an asset class at all. Definition of asset classes can be accomplished with greater confidence when returns are market-generated, not resulting from active management, and when the securities comprising the asset class are traded in broad, deep and investable markets (Swensen, 2005).

As a practical matter, a large number of asset classes have been defined in the global securities markets, and these classes have mostly proven reasonably stable over time.

II. Criteria for Including Asset Classes

In deciding upon asset classes for inclusion in an investment portfolio, PW&Co considers the following criteria:

- Underlying source of return

- Diversification benefit potential

- Investment scale required

- Liquidity

- An explanation of each of these criteria follows.

A. Underlying Source of Return

Macroeconomic theory states that capital when combined with labor in an economy will produce economic growth. Markets work reasonably well in allocating capital to generate growth. Assets invested in the fundamental economy can be expected to generate return and are the only ones PW&Co recommends for investment portfolios.

It is important to distinguish between fundamental economic assets and speculative assets. Not all markets trade fundamental assets. Many markets exist to allow buyers and sellers of fundamental assets to enter into agreements to lay off price risk. Speculators help create liquidity in these markets. Futures and option contracts derive their value from the underlying assets and are therefore called “derivatives.” Derivatives are speculative in nature for those who do not already own (or need to purchase) the underlying asset in which they are trading. The sum-total of all open contracts in these markets adds up to zero. The expected return of this market, by construction, must therefore be zero. Speculators can earn profits, but only at the expense of another market player.

Other types of markets have an entertainment as well as a speculative component. Horses are a good example of this type of market. Formerly, a horse was a valuable engine of the economy allowing farmers to till fields and businesses to transport goods. They no longer serve this fundamental function, yet a thriving industry exists to breed, show and race horses. Participants in this market (i.e., breeders, owners) can create profits to the extent others are willing to consume (through betting, attending events, etc.). Ownership units in prize thoroughbred horses can be purchased in expectation of future stud fees. Horse breeding is in essence a “micro-economy” that no longer serves a productive function, only an entertainment one. Returns in this type of economy are speculative in nature and highly dependent on individuals’ willingness to continue to spend money.

B. Diversification Benefit Potential

Once an asset class’ source of return has been identified, its impact on portfolio return must be considered. Asset classes should behave differently from (or have low return correlations with) other asset classes in the portfolio. These correlation characteristics should be stable and expected to continue in the future.

For example, alternative asset classes are often touted for their low correlation and benefit to portfolio diversification. However hedge funds that advertise the same strategy have returns that are highly uncorrelated with each other (Kat, H.M. 2003). Without a reliable risk-return relationship, it is difficult to conclude that their correlation benefit will continue or even whether they are separate asset classes to begin with. It is also possible for the style of investing (i.e. active management) in an asset class to reduce the potential for diversification benefits.

Some securities, such as convertible bonds, are really hybrid securities composed of underlying bonds and an equity option. While convertibles may seem to provide low correlation, a better way to achieve the return benefit would be to own the underlying stock and bonds of the issuer itself.

C. Investment Scale Required

Some asset classes may have attractive economic fundamentals and diversification benefits, yet it may be difficult for an investor to realize benefits on a cost effective basis. Some investments, by their nature, require significant scale. Investment vehicles that provide access may require significant minimum investments that are intended for institutional size investors (>$100 million) and make it costly for smaller investors to access.

Timber is a good example of an asset class that has attractive economic characteristics and diversification benefits, yet is hard for smaller investors to access. In order to achieve broad timber diversification, a timber fund must own over $100 million in timber land. Funds of this size have large minimum investments requirements (i.e., in excess of $10 million) that make it out of reach for smaller investors. Smaller investors can always purchase timber lands directly, but they would be subject to specific risk due to lack of diversification.

For some types of investments, it is also important to have in-house monitoring capability. The Yale Endowment is a good example of a large investment pool with a dedicated in-house staff that has been able to encourage good management practices by management of private equity and other alternative investments. Given the large amount of funds invested, the fixed management cost is so small that it has a minimal drag on returns. Financial intermediaries have tried to imitate this activity by setting up so-called “fund-of-funds” vehicles, but these vehicles have an added level of fees and expenses that raise the bar required for net return on the investment.

D. Liquidity

Liquidity can be defined simply as the ability to get one’s money back. Short term US Treasury bills are the most liquid of investments. There is a deep market where the price is set by many buyers and sellers. The change in interest rates on any given day is sufficiently small that it is highly unlikely that investors would not be able to sell and get their money back. Stocks are not as liquid. Particularly in the case of large blocks of small cap stocks, quick sales may require discounts of 10% or more from previous price levels.

Some investment vehicles have specific lock-up periods where investors are unable to get their money back. Hedge funds often have a specified period during which sales or redemptions are not permitted. Venture capital funds have longer periods of time to return capital to their investors. By their nature, they invest in private companies that are not traded, and it is expected that money will not be returned to the venture fund investor for up to 10 years.

Exchange traded assets have different levels of liquidity as well, but for purposes of selecting asset classes, the underlying liquidity of the investment options in that asset class must be considered in light of each client’s liquidity requirements.

III. Review of Asset Class Considered

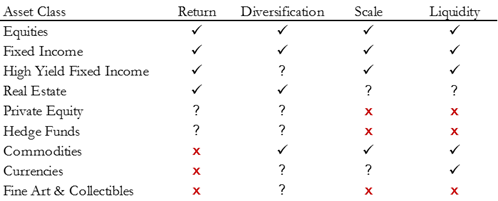

Using these four criteria, we can filter various investment options that are sometimes included in institutional portfolios. The only two asset classes that meet all criteria are public, exchange traded equities and fixed income. The issues with the remaining asset classes are discussed below.

Table 1: Criteria Applied to Asset Classes

A. High Yield Fixed Income

While this asset class appears to have good fundamental properties relating to return and sufficient liquidity through pooled investments, the diversification potential of this asset class is limited. High Yield Fixed Income bonds are a combination of debt and equity and behave more like equity the worse their credit rating. Their return potential is capped by the coupon, so the underlying equity may be a better way to invest. The diversification benefits of high yield bonds are limited, particularly when real estate (through REITs) is included.

B. Real Estate

This asset class has attractive return and diversification benefits. Direct investments in real estate (or private partnerships) have scale and liquidity issues, but some exposure to real estate can be achieved through real-estate investment trusts (REITs).

C. Private Equity

Private equity is really not an asset class but a way to achieve exposure to non-publicly traded, illiquid asset classes. Primarily for liquidity and scale concerns, we do not consider this investment option.

D. Hedge Funds

A separate white paper (“Hedge Funds: Do You Get What You Pay For?” No. 16) is entirely devoted to the topic of hedge funds. In short, this investment option has problems similar to those of private equity but with additional liquidity and returns (net of fees) concerns.

E. Commodities, Currencies and Collectibles

Portfolios are able to achieve exposure to commodities by owning companies that own the assets directly. Most commodity pool investments are speculative in nature, and thus are eliminated due to the source of their returns. Currency pools and collectibles are similarly speculative in nature.

IV. Conclusion

Assets that (i) do not have specific risk-return characteristics or (ii) do not have expected return, are not appropriate for the prudent, risk-return maximizing investor’s portfolio, as their inclusion can significantly undermine the objectives and benefits of diversification. Some other assets are generally not appropriate for clients’ portfolios because they are highly illiquid or require especially large amounts of capital. Asset allocation among asset classes recommended by PW&Co should receive careful consideration developed in an investment policy statement.

V. Appendix

Research has shown that asset allocation policy determines approximately 90% of the variation in returns across time (Brinson, Hood, & Beebower, 1986; Brinson, Singer, & Beebower, 1991; Hood, 2005; Ibbotson & Kaplan, 2000). However, many people have misinterpreted the research to mean that 90% of the return across funds is explained by asset allocation policy differences. Ibbotson & Kaplan (2000) clarify the misunderstanding and show that 40% of the variation in return across funds is determined by asset allocation policy differences.

The 90% number quoted by researchers is arrived at through a time series regression analysis. For each month, the return of the portfolio is regressed on the return of the portfolio’s policy. A scatter plot of the monthly fund returns and monthly policy returns for one portfolio in the sample from the Ibbotson & Kaplan study (2000) is illustrated in Figure 1. A time series regression for each portfolio in the sample is performed and the R-Squared measure, which measures how well the independent variable (monthly policy return) explains the dependent variable (monthly fund return), for each portfolio is averaged together. An R-Squared of 0.90 indicates that 90% of the variability in investment portfolio returns is explained by the portfolio’s policy returns across time.

Figure 1: Time-Series Regression of Monthly Fund Return versus Fund Policy Return, April 1988-March 1998

Source: Ibbotson & Kaplan (2000)

The 40% number quoted by Ibbotson & Kaplan (2000) comes from a cross sectional regression analysis. For each portfolio, the 10-Year total portfolio return is regressed on the 10-Year total policy return. A scatter plot of the total fund return and total policy return for each portfolio in the Ibbotson & Kaplan study (2000) is displayed in Figure 2, which shows a weaker fit around the regression line compared to Figure 1 as indicated by the lower R-Squared of 0.40. An R-Squared of 0.40 indicates that 40% of the variability in investment portfolio returns is explained by the portfolio’s policy returns across funds.

Figure 2: Fund versus Policy: 10-Year Compound Return Across Funds, April 1988-March1998

Source: Ibbotson & Kaplan (2000)

Policy returns do a better job of predicting portfolio returns across time than they do across funds. Regardless of which question is addressed, though, the most important factor in determining the performance of portfolios is the selection of asset classes.

VI. Bibliography

Brinson, G. P., Hood, L. R., & Beebower, G. L. (1986). Determinants of Portfolio Performance. Financial Analysts Journal , 39-44.

Brinson, G. P., Singer, B. D., & Beebower, G. L. (1991). Determinants of Portfolio Performance II: An Update. Financial Analysts Journal , 40-48.

Hood, R. L. (2005). Determinants of Portfolio Performance – 20 Years Later. Financial Analysts Journal , 6-8.

Ibbotson, R. G., & Kaplan, P. D. (2000). Does Asset Allocation Policy Explain 40%, 90%, or 100% of Performance? Financial Analysts Journal , 26-33.

Kat, H. M. (2003). 10 Things That Investors Should Know About Hedge Funds. Journal of Wealth Management , 72-81.

Swensen, D. F. (2005). Unconventional Success. New York: Free Press.