Having experienced a period of falling rates that have positively influenced the return on bonds, many people are worried about the prospects that interest rates will increase. We do not believe that we can profit by predicting interest rates or timing the market. We do think it is important to understand what the market is telling us about interest rates and expectations for the future.

I. Exam Question

Imagine you are a CFA Level 1 candidate sitting for the first of your three exams. You are facing the following question:

Q: If the current 1 year and 2 year treasury rates are 0.47% and 1.14% respectively, what is the 1-year interest rate, 1 year from now implied by the Expectations Theory?

The answer to this question is based on the fact that investors have two options for investing. First, the investor could buy a two year bond and earn 1.14% interest for two years, for a total of 2.28% simple interest. Second, the investor could invest in the 1 year bond and earn .47% interest the first year and then invest this amount in the one year bond again at the prevailing rate one year from now. Because the Treasury bond market is very liquid, it must be the case that the investor should expect[1] to earn the same amount of interest no matter which option is chosen. It must be the case, using simple interest, that the interest earned in the second year should be (2.28% – 0.47%) or 1.81%.

The correct answer below uses compound interest to more accurately calculate the rate, which happens to produce the same answer as the simple interest estimate above.

A: [(1 + 1.14%)^2 / (1 + 0.47%)] – 1 = 1.81%

We might then ask the question if you thought that one year rates were going to be higher than 1.81% one year from now, how should you invest. The answer would be to invest in one-year bonds (not two-year bonds), since that would earn more interest over time based on your expectations.

The pure expectations theory has its limitations in that it makes assumptions about the liquidity of bonds and the absence of risk premiums on future interest rates that are incorporated into more complicated theories and models. In spite of these limitations, the expectations theory is a good guide to help us understand interest rates now and in the future.

II. Current Market Environment

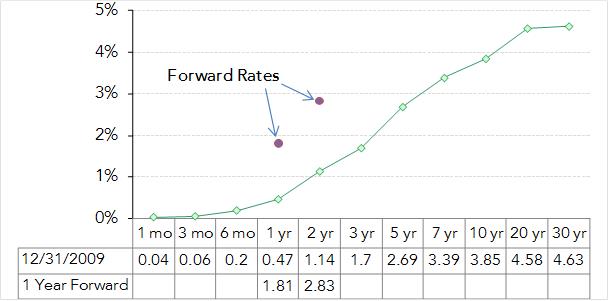

The current treasury yield curve, or the graph of treasury yields over different maturities is upward sloping, as shown in Figure 1 below. The ten year rate of 3.85% is much higher the one year rate of 0.47%.

Figure 1: Treasury Yield Curve

We can use this curve to calculate the expected one year rates one and two years from now which are 1.81% and 2.83% respectively. In other words, an investor who invests in a 1 year bond today can expect to be able to re-invest in a one year bond yielding 1.81% one year from now and to re-invest 2 years from now in a bond yielding 2.83%. This investment would earn the same interest as investing in a 3 year bond earning 1.7% today. Using similar math, the 10 year bond, 10 years from now is expected to yield 5.32%.

Based on this analysis, we should not be surprised if interest rates increase. On the contrary, we should be surprised if they do not.

III. Implications of Interest Rate Environment

Periods of high interest rates are typically ones where either expected inflation is high or economic activity is robust. If the yield curve is upward sloping, that typically is a “bullish” signal on economic activity. It could also mean that inflation is expected to increase. Inflation expectations can be checked by considering the yield curve for inflation protected securities. Conversely, periods of falling interest rates, or negative sloping yield curves, are typically ones where economic activity is slowing (ie, recession) and stock market returns are below average.

Interest rates can also increase or decrease based on supply and demand for the underlying bond. If the market has no appetite for a bond, the effective rate becomes infinite, as was the case for many auction rate securities in the recent past. Hopefully, the demand for US Government securities will remain robust, but it is an element to monitor in view of expected large deficits.

IV. Implications for Long Term Investors

Long term investors with time horizons of 10 years or more typically do not know when they will need funds in the future, so purchasing individual bonds that mature on the date funds are needed is a strategy that is not often employed.[2] Most long term investors have fixed income investments with a maturity less than their time horizon, so those investments are subject to “re-investment risk.” Since an investor cannot know what interest rates will be when their holdings mature and need to be invested again at then current rates, the investor will be exposed to changes in interest rates.

Decreases in interest rates will positively influence bond prices in the short term, but long term investors will then be forced to reinvest their holdings at lower rates. Increases in interest rates will negatively influence bond prices in the short term, but long term investors will have the opportunity to reinvest their holdings at higher rates in the future.

We are more worried about falling interest rates, or the need for the Federal Reserve to maintain low short term interest rates, than increasing interest rates. Most of our clients have some exposure to equities which are adversely impacted by poor economic growth. We are also more worried about the negative effect of inflation if monetary policy is not tightly controlled.

Currently, the market expects rates to go up in the future. The market’s expectation is not always a good prediction, but it is an unbiased one. We do not pretend to be able to predict interest rates but focus instead on determining the appropriate amount, credit quality and duration of the fixed income holdings in our client portfolios. We adjust these allocations as our client’s situation evolves and adjust our return expectations based on prevailing market interest rates.

[2] If an investor knows how much money will be needed on a certain date, then buying bonds that mature on that date is a good strategy. This strategy will eliminate the investor’s exposure to interest rate changes. [IMC 3]