In order to make sound investment decisions today, we are forced on making long term projections of portfolio returns. The methodology, assumptions, and original inputs for our approach to predicting long term portfolio returns are originally documented in our white paper titled, Projecting Long Term Portfolio Returns[1]. This paper updates the original with data as of December 31, 2017. Using the same methodology, the expected return for a balanced portfolio decreased by 0.81% to 6.45% at the end of 2017, or 4.36% after inflation.

I. Risk

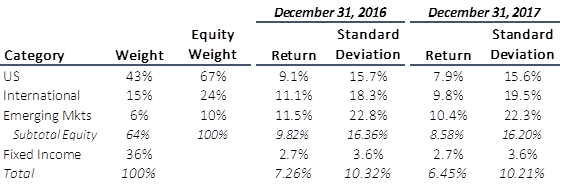

Modern Portfolio Theory relies on volatility of prices as a proxy for risk and derives estimates of volatility from representative indexes. For the representative indexes, we updated the standard deviations and correlations using the last 10 years of index data. Overall, across the major asset classes – US, International, Emerging Markets, and Bonds, correlations slightly decreased.

II. Bond Returns

We assume that the current yield on the 10-year Treasury equals the return earned on Treasuries over the next 10 years. For non-Treasury securities, we also adjust for the credit risk using the current spread in yields between comparable duration treasuries and corporates. We updated the 10 year Nominal and TIPS Treasury yields as well as the indexes representative of corporates, and their corresponding correlations. The 10-year Nominal Treasury yield decreased from 2.45% to 2.40% during 2017. The 10-year TIPS yield decreased from 0.50% to 0.44%. The assumed credit spread in yield attributable to corporates remained the same at 0.5%. The Federal Reserve reports that its latest estimate of 10-year expected inflation is 2.00%.

III. Equity Returns

For the purposes of our projection, we consider the size and value factor premiums. Our resulting model for the expected return on equity is:

E[Equity Return] = Risk Free Rate + Market Factor + Factor Premium

A. Risk Free Rate

We assume that the Risk Free Rate should be the yield on US Treasury security with a maturity equal to the investor’s time horizon, but not greater than 10 years. The 10-year Treasury yield is the assumed risk free rate and was updated from 2.45% to 2.40%.

B. Market Factor

The combination of Beta and the Equity Risk Premium is often referred to as the “Market Factor”. We continue to assume beta is 1.0 for all classes other than utility stocks where we use Damodaran’s estimated beta of 0.7[2]. For equity risk premiums, we use Damadoran’s implied equity risk premium approach. Using updated Damadoran equity risk premiums and credit ratings for US, Emerging Markets, and EAFE, expected returns dropped. The US premium decreased from 5.69% to 5.08%. The international premium dropped from 6.31% to 5.59%. The emerging markets premium decreased from 7.66% to 6.74%. The country risk premium went from 1.23% to 1.12%.

C. Factor Premiums

Our model considers the size and value factor premiums. We use long term historical averages as the best predictors of the future. As such, we updated the historical annualized return and standard deviation for our representative portfolios in US, international developed, and emerging markets. The current price-to-book and weighted market cap figures were updated for the representative portfolios and indexes. Factor premiums across US, international developed, and emerging markets all generally decreased.

IV. Return Comparison

For a diversified portfolio of 64% equities and 36% fixed income we project as of December 31, 2017, a 10-year annualized portfolio return of 6.45%, compared to a return of 7.26% as of December 31, 2016. The decrease in return within in each asset class contributes to an overall decrease in return accompanied by a reduced projected volatility for US and emerging markets, and increased projected volatility internationally.

[2] Damodaran, Aswath. Damodaran Online, January 5, 2018, http://www.damodaran.com.