As the frenzy of tax season subsides, now is an opportune time to examine your financial records and make sure that everything is in order. One goal for our clients is to help them organize their financial “household,” which not only makes record-keeping easier, but also helps a financial advisor have a comprehensive picture of financial planning needs. Putting all the pieces together in a coherent structure enhances situational awareness from a financial point of view and leads to better financial decisions.

The following items, while not exhaustive, can go a long way to catch any issues now before they create bigger problems down the road.

I. Revisit Your Estate Documents

If it has been more than five years since your estate documents were reviewed or there have been significant life events (birth, death, marriage, substantial change in net worth, etc.), it is worth another look. When the tragic death of actor Phillip Seymour Hoffman occurred, the public probate of his will revealed that the estate documents had not been updated since his wealth grew considerably.[1] He also had two additional children, who were not mentioned. The original will was not flexible enough to deal adequately with his heirs. Proper planning could have most likely reduced his estate tax bill, ensured that his wishes were carried out for all three of his children, and kept his estate matters private.

II. Check Beneficiaries

Custodians of retirement accounts are legally bound to follow beneficiary designations. An outdated designation will cause the transfer of an IRA to an ex-spouse, if that is what the document stated. With more complex estate arrangements, have your estate attorney assist with filling out beneficiary forms. Be sure to check beneficiary designations for the following items:

- Employer sponsored retirement plans (current and prior, if applicable).

- IRA accounts

- Life Insurance

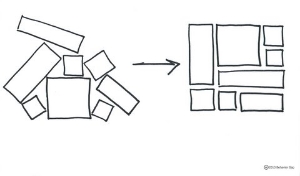

III. Consolidate Assets

The state of Alabama currently holds over $420 million in unclaimed assets,[2] ranging from cash to stock certificates to insurance proceeds, and our goal is to help ensure that our clients’ assets do not end up adding to that amount (or remaining there!). As you travel through different life stages, it is beneficial to all family members to track down and consolidate assets as much as possible. Also, as your tax preparer will most surely attest, those who have not made an effort to organize financial assets impose a considerable amount of additional time and effort on tax advisors.

A. Retirement Accounts

As of 2008, the median length of job tenure for Generations X and Y is 4.1 years, meaning younger employees often do not expect to remain with one company. While you may move on to a better position, your retirement account often gets left behind. By setting up a Rollover IRA and transferring retirement assets shortly after a career move, you are able to keep the protections afforded under the prior ERISA-backed plan and can more easily keep track of assets. Consolidating accounts helps you reduce the risk of losing track of the assets or accidentally over-contributing to your retirement account if a career move is made mid-year.

B. Stock Certificates and Direct Investment Accounts

Registering stock certificates “in street name” in a brokerage account and consolidating smaller brokerage and direct investment accounts are beneficial for several reasons:

- Stock certificates are at more risk of being lost or stolen. They can be reissued, but often with a hefty fee.

- Getting organized for tax preparation will be easier with fewer documents to track down.

- Your heirs will spend less time battling minutiae when working to clear up your estate.

- Financial advisors can help you plan more accurately based on a true picture of your financial situation.

In summary, taking stock of your financial household will not only address potential problems but also give you some peace of mind that your affairs are in order. To read more about our Wealth Management practice and ways that we help our clients, click here.

[2] https://www.moneyquest.alabama.gov/about.aspx?id=11, accessed April 22, 2014.