This is the second of three comments on the use of valuation multiples. All three comments are posted on the website.

When investors and business owners quote public company valuation multiples to demonstrate the value of their company, they are typically overstating its value. While the trading of public companies in the stock market provides a directly observable industry valuation metric at a specific point in time, public company multiples (P/E, EV/EBITDA, etc.) typically reflect large companies, which aren’t as risky as small companies in the same industry and require lower returns. In order to arrive at a more accurate valuation for a small private company, we adjust public valuation multiples using published size studies to incorporate a small company risk premium into the large company multiple.

Many research studies have demonstrated that on average, smaller companies earn higher rates of return than larger companies. In order to account for the additional risk (total risk) and higher rates of returns in small companies, a size premium must be added to the equity risk premium. In order to estimate the size premium, we use the annual Duff & Phelps Risk Premium Report. The Duff & Phelps methodology uses regression analysis to measure historical realized risk premiums (risk premium for the market and risk premium for size) from a historical dataset of companies. To apply this risk methodology to public valuation multiples, the inverse of the multiple (capitalization rate) must be adjusted using size risk premiums. There are eight measures of size that we use to adjust multiples: total assets, five year average EBITDA, five year average net income, number of employees, market value of equity, market value of invested capital, and book value of equity. Size premiums for each comparable company are then calculated using regression equations based on company revenue, leverage, and corporate tax rate. The valuation multiples are then adjusted to reflect the difference between the size premiums of the public companies and the small private company.

To illustrate an example of a size adjustment, assume that a large public healthcare company (“HL”) with $1 billion in sales is trading at 10.0x EBITDA, and you own a minority interest in a small healthcare company (“HS”) with only $10 million in sales. We first convert HL’s valuation multiple into a capitalization rate (cap rate) using the inverse of the valuation multiple. A capitalization rate is equivalent to the risk of the earnings stream in the multiple less the expected growth of the earnings (risk minus growth). HL’s EBITDA multiple converts to a 10% cap rate.

![]()

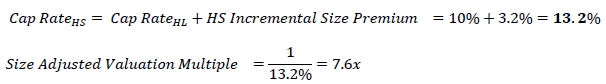

After calculating HL’s cap rate, we use the regression equation from the Duff & Phelps study to calculate the size premiums for both companies. In this example, the size premium for HL is 4.4% and the size premium for HS is 7.6%. This represents an additional 3.2% of risk attributable to size.

![]()

We then add the incremental size premium to the HL’s cap rate to determine the HS’s cap rate. Once we have HS’s cap rate, we can convert the size adjusted cap rate to a size adjusted valuation multiple. After the size adjustment, the public multiple decreased from 10.0x to 7.6x.

As shown in the example above, a healthcare company with only $10 million in sales is worth 24% less than the larger publicly traded companies, after only taking into account size factors. This is one of the ways private equity firms can create value from acquiring and merging small companies in the same industry (called a “roll-up”). For example, a combination of ten identical $10 million companies into one $100 million revenue healthcare company would increase the new company’s adjusted valuation multiple to approximately 8.6 times EBITDA, generating a 15% return increase in value without taking into account any synergies or cost savings. Is this too good to be true? Maybe. We will address this in a future article.