We use multiples all the time. “It was twice as hot yesterday than today.” “The drive took three times as long because of traffic.” “I would pay five times the company’s dividend to own that stock.” In these cases, as well as in financial analysis, multiples are used to examine a relative relationship.

For example, let’s say there are two widget companies, both of which make 10 widgets, earn $1 per widget, and are expected to grow at the same rate. Why would I be willing to pay five times per widget for Company A but only two times per widget for Company B? Let’s say that Company A is in Birmingham, and Company B is in Ukraine. Therefore, I believe that Company A is less risky than Company B, and I am willing to pay more to own Company A stock.

A valuation multiple is, in short, an indication of market value relative to a key statistic that is thought to directly relate to value. The statistic (e.g., EBITDA, net income, total assets, etc.) must logically and economically relate to the desired value. Multiples are simple to calculate, easy to understand, based on relevant metrics that inform investors, and incorporate current market conditions. Multiple analyses can be especially useful in deriving a value for a private company for which there have been no direct transactions in the company stock. We identify and analyze multiples of publicly traded companies and recent public and private company transactions in the same industry to determine multiples prevalent in the industry.

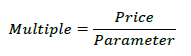

There are two types of valuation multiples: enterprise value (value of entire company that both debt and equity holders are entitled to) and equity (value equity holders are entitled to). The generic market based valuation ratio is shown below.

“Price” is typically either the market value of equity or the enterprise value of the company. “Parameter” can be any income statement or balance sheet item (e.g., sales, net income, book value, etc.) that is relevant to the desired value. We typically analyze different industry multiples and find that this approach often provides critical insights into the value drivers in a given industry.

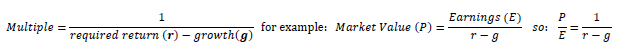

Multiples analyses can allow a financial analyst to compare a given company to its industry peers and help verify and test the plausibility of financial forecasts; however, multiples are often misapplied and misunderstood. Many finance professionals will take an industry price-to-earnings (P/E) ratio and apply it directly to the earnings of a specific company. This is problematic if the company has different growth prospects, risk characteristics, and capital structure.

The problem with careless use of multiples becomes apparent in the formulas below – any factor that contributes to more or less risk or growth than the average public company could require a multiple adjustment. The derivation of the P/E formula has been included in the footnotes.[i]

When valuing small private companies, it is often difficult to find directly comparable companies and transactions. The private company often operates in a small niche business, and even if there has been acquisition and divestiture activity in this industry, small deals are often not reported and data is limited. This sometimes requires the analyst to consider companies in related industries that sell related products or services and have similar risks. Even if the comparables are not identical to the subject company, analyzing the multiples still provides an indication of how the market has changed over time and provides a sanity check on other valuation methods.