Overview

Which is better, Traditional (Regular) or Roth contributions? The answer mostly depends on current and future tax rates.

- Regular contributions are deductible from current year income (reducing taxes paid in that year) but any withdrawals are taxable. (Hence why they are often called “tax-deferred.”)

- Roth contributions do not provide a tax deduction in the year they are made, but the withdrawals, along with the earnings, are not subject to tax.

If an individual’s tax rate is expected to be higher in the future when withdrawals are made, then they should be better off with a Roth account. Since there is so much uncertainty about what rate might be in the future, investors are often better off with dividing their savings between both.

Simplified Example

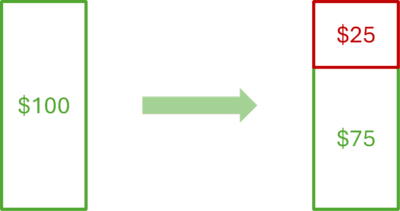

For example, let’s assume an investor is in the 25% tax bracket and has $100 to contribute. Since the contribution reduces taxable income, the full $100 can be contributed. a traditional account. Later, when the $100 is withdrawn, the investor will pay $25 in taxes and be left with $75.

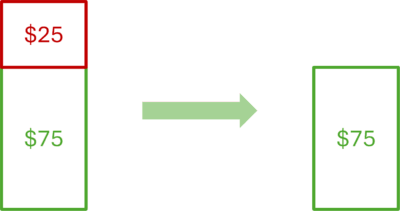

If the same $100 were allocated to a Roth account, the investor would need to pay $25 in taxes leaving only $75 to invest. When the contribution is withdrawn, there are no taxes to pay leaving the same $75.

The result is the same because the tax rates when the contribution and withdrawals are assumed to be the same. While this simple example has assumed no earnings, the result would be the same if there were earnings. If the contribution doubled, then the investor could withdraw $150 net of tax in both cases.

The Fine Print

The real world is more complicated and uncertain. Even if tax brackets remain the same, they have different levels or tiers. A withdrawal from a traditional account fills up lower brackets first before incurring higher marginal tax rates. The withdrawal faces an average tax rate that might be lower than the marginal tax rate when the contribution was made.

Roth contributions are not subject to required minimum distributions (RMDs). Participants over the age of 73 who are retired generally must take annual RMDs from traditional retirement accounts. Large distributions could be subject to higher tax rates on the margin than when the contribution was made.

Having a Roth account can help smooth out tax rates. If unexpected expenses arise, withdrawals can be taken from the Roth account instead of a traditional account which might be subject to higher tax rates on the margin.

Given the uncertainty about future tax rates, making contributions to both Roth and Regular accounts over time is a good way to reduce the impact of future changes in tax rates on retirement savings.

A number of simplifying assumptions have been made and details omitted for purposes of analysis. Consequently, readers are encouraged to seek competent tax counsel and not rely solely on any of the statements made herein. Any advice concerning U.S. federal tax issues contained in this communication is not intended or written to be used for the purpose of (1) avoiding penalties under the Internal Revenue Code or (2) promoting, marketing or recommending to another party any transaction or tax-related matter addressed herein.